Hotels exempted from paying VAT on accommodation

Reviewing a number of tax amendment Bills on Wednesday, Bahati informed Parliament that hotels in Kampala will also be included on the exemption list.

HEALTH VIRUS

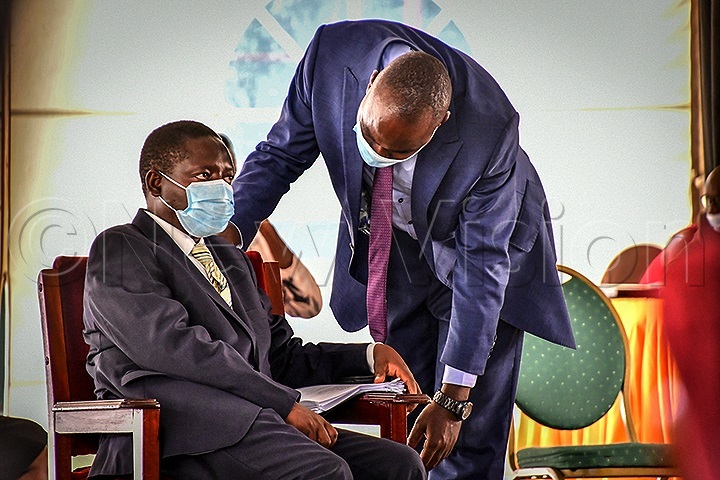

KAMPALA - As part of Government efforts to promote tourism during COVID-19, the state minister of finance, David Bahati, has announced that all hotels across the country will be exempted from paying Value-added tax (VAT) on accommodation.

Reviewing a number of tax amendment Bills on Wednesday, Bahati informed Parliament that hotels in Kampala will also be included on the exemption list.

Previously the exemption applied only to upcountry hotels for purposes of encouraging investors to invest in the country.

"Because of COVID-19, we have realised that hotels in Kampala also need this tax relief. We have decided to include them on the list," he said.

Tourism is one of the sectors that has been adversely affected by COVID-19 pandemic.

Some MPs, however, requested the minister to remove the VAT on other items such as drinks in the hotels. The House is currently scrutinizing the tax amendment Bills.

Uganda earned $1.6b (about shs5.8 trillion) from tourism in the 2018/2019 financial year, making the sector the country's leading foreign exchange earner for the fifth year in a row.

In July, Jeanne Byamugisha, the executive director of the Uganda Hotel Owners Association (UHOA)said it was envisioned that Uganda was going to lose sh5.858Trillion ($1.6bn) in the tourism industry this year alone due to the COVID-19 pandemic.