Bank of Uganda shoring up reserves

The current buying interest from Bank of Uganda aimed at shoring up the reserves is an addition to the demand list.

SHILLING FINANCE

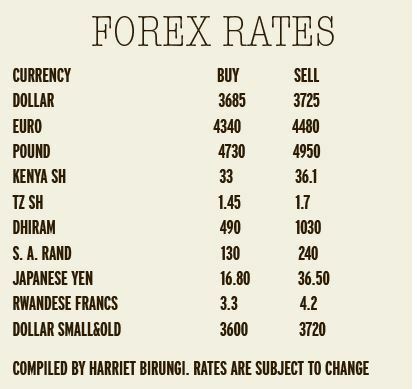

The shilling opened the week trading stable at the 3685/ 3695 levels, unchanged from last week's close, an Absa Bank report indicates.

Richard Nsubuga, the Absa Bank trader, said the dollar supply from commodity exporters and offshores is expected to be easily squared out by the existing demand from the energy, telecoms, oils and manufacturing sector.

The current buying interest from Bank of Uganda aimed at shoring up the reserves is an addition to the demand list.

"We expect the shilling to trade stable within the 3675- 3700 range with balanced demand and supply likely for the week," Nsubuga said.

The money markets remained liquid with overnight at an average of 7.00%. A report maturity above sh700b is expected into the market this Thursday. The secondary market continues to be active with buying interest from both local and foreign investors seen across the curve.

There is a treasury bill auction worth sh245b and yields are expected to clear largely flat across the tenors.

The Kenya shilling oscillated around the 109 handles on Monday with increased demand from SME and oils ticking the pair higher despite central bank intervention.

The Kenya shilling opened the week at 108.80/20 and slowly trended lower to 108.70/00 on the back of the central bank's intervention by close of Monday. The local unit is expected to trade within 108.20/109.50 levels this week.

The dollar eased back from one-month highs against a currency basket on Tuesday as investors took a breather after a recent rally driven by safe-haven demand. Still, the greenback shined as the best alternative investment and held above 93.5 amid lingering concerns over the economic recovery from the coronavirus pandemic.

The pound fell against the dollar on Monday as delayed EU-UK trade talks and rising COVID-19 cases, that may see the UK renew lockdown restrictions and strain investor sentiment. The pound rally may have officially lost its steam, consistently closing out sessions below the $1.3000 psychological level for over a week now, as the UK's shortcomings are finally catching up with the pound. The pound reached a low $1.2794 to end the session at $1.2816.

The euro slid to one-week lows on Monday as newly imposed lockdown restrictions in Spain, the European Central Bank's Lagarde's claims of an uncertain economic rebound and a concerning strong euro diminished the euro bulls' optimism. The shared currency weakened to $1.1730 to end the session at $1.1771.