How much will Ugandans earn from $20b oil projects money?

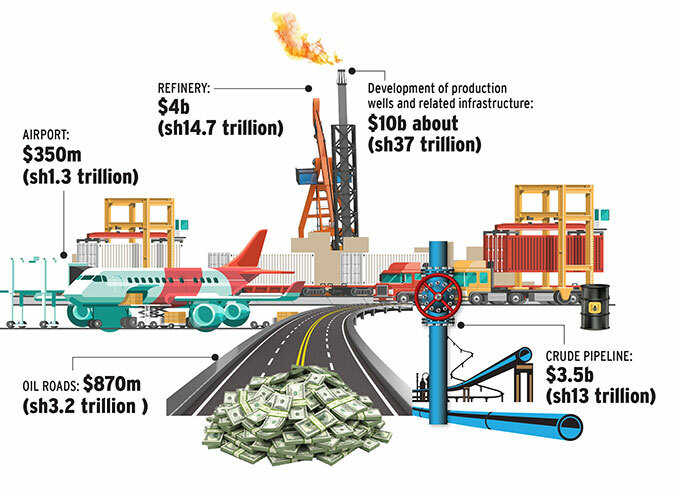

It is estimated that about between $15b and $20b will be spent during the development phase of the oil industry.

OIL AND GAS

Patrick Mugisa (not real names) leaves home before 5:00 am to catch a bus from Hoima town to Nyamasoga village in Kabaale parish every day. The bus, belonging to the company building Uganda's second international airport in Hoima, sets off at 6:10 am and arrives at the construction site within 40 minutes.

Mugisa is part of the local casual labour force that company ferries from Hoima to the project site daily. The bus delivers the workers to Hoima town after work at 7:30pm. Mugisa operates an excavator in the quarrying site, earning about sh400, 000 monthly.

There are nearly 1, 000 Ugandans working on the project, most of them in low-grade jobs such as drivers, foremen, surveyors, mechanics and lab technicians. The highest positions held by Ugandans on the projects are sanitation, administrative, environmental officers, according to our investigation.

Yet there are only about 20 expatriates taking home between $10,000 and $30,000 in monthly earnings. This means seven expatriates earning, for instance, $15,000 each (over sh55m) take home sh385m in monthly earnings. This is nearly equivalent to salaries of 1,000 Ugandans, with each taking home sh400, 000. A substantial number of local workers on the project earn sh400, 000 per month.

"You can see we work for more than 12 hours and that is what we earn. And that money includes lunch and accommodation in Hoima town," a worker said.

The investigation's findings raise questions on how much Ugandans would earn from the development phase of the oil industry; through direct employment and supply of goods and services. It is estimated that about between $15b and $20b will be spent during the development phase of the oil industry.

The money is expected to be spent on development of wells for oil production, infield pipelines, central processing facilities, water abstraction and injection plants, the refinery and Uganda-Tanzania pipeline. Part of that money is already being spent on building ten oil roads and Hoima International Airport.

The energy ministry officials have severally said that if only 40% of the oil projects money could be retained in the economy, the country would not remain the same. Their assessment is based on the estimated 28% of the money which is said to have been earned by Ugandan suppliers of goods and services during the first exploration round. The oil companies said they spent over $3b during that phase.

The Ugandans reportedly earned the 28% thorough providing a range of services, including clearing and forwarding, security, camp management, catering, environmental studies, building well pads, roads, supply of foods, transport, camp facilities, insurance, banking and employment.

Although the oil roads and the airport are not regarded as petroleum upstream projects and are not covered by the local content regulations, the money being spent on the two projects is part of the estimated $20b that would be expended by Uganda government and oil companies during the development phase of the petroleum industry.

Does the number of Ugandans employed on the airport project and the positions they hold represent an idea of what would happen on future oil projects?

The chairman of the chamber of mines and petroleum, Elly Karuhanga, said Uganda could even surpass the 40% mark. "The delay in starting production may even be a blessing. We have ample time to train and skill Ugandans. It may be 40% or above, but it will not be below what it was previously," he added.

However, Karuhanga observed that having a large local labour force on a project does not translate into increased local content benefits. This reflects the picture at the airport project.

"You can have 80% Ugandans and 20% foreigners on the project. But the 20% may be taking 80% of the salaries. It is important to skill people so they compete for good jobs," he noted.

While construction materials like sand, gravel and stones are items Ugandans can ably supply to the oil and gas construction projects, the companies building the airport and oil roads are crushing the rocks and supplying to themselves the construction aggregate.

Yet under the 2016 local content regulations for the oil and gas industry, the supply of materials like stones is ring-fenced for Ugandans. SBC Uganda, a consortium comprising SBI International from Switzerland and Colas Limited from UK, is building the airport. Several Chinese companies are building the roads.

The builders of these projects leased the land (with rocks) from the local landlords. They crush the rocks and deliver the construction aggregate to the projects' sites through foreign contractors. The suppliers of the locally available stones are actually foreign companies. Instead, it is the foreign subcontractors that sell aggregate to the main contractors.

The Ugandan subcontractors who need aggregate to undertake the tasks assigned to them, especially on oil roads being built by the Chinese companies, have to buy it (aggregate) from the main contractors for $14 per ton.

But the decision by the multinationals to engage in stone crushing business and hire subcontractors from the countries where they are domiciled, however, is partly informed by the limited capacity of Ugandan firms and the conditions of the lenders of the money used to execute the projects.

The main contractors are also reluctant to subcontract the rock crushing activities to the Ugandan firms because it is one of the lucrative components of the contracts and it provides opportunities for inflating the projects' costs, according to sources.

The airport and the roads are being constructed to facilitate movement of equipment needed for the development phase of the industry. Since oil is capital intensive industry which is not expected to employ many Ugandans directly, it is thought that nationals would earn more money through local content opportunities.

All these projects are being undertaken through loans, but the conditions attached to the credit, the supposed absence of capacities among Ugandans to take up key positions on the projects and supply of construction materials by international firms, will reduce local content opportunities for Uganda.

SBC hired 100 acres of land for six years for sh600m from a local landlord - Enock Muhanika - in Nyamasoga village near the project site. The company established a quarry on the land where it crushes rocks into aggregate. The sh600m translates into sh1m for each acre every year in six years.

The landlords rent out an acre to local farmers in the area for sh200, 000 for three months. This translates into sh1.2m in 12 months. But since a big part of his land is rocky and not suitable for agriculture, he could not rent out the whole of it to farmers. But the landlord would have earned more money if he had supplied the construction aggregate to the contractor.

According to the contract documents which SBC submitted to the works and transport ministry, which awarded it the (contract), the company will need over 980,000 tons of aggregate for the airport construction. All the aggregate needed is likely to be generated from Muhanika's land.

If Muhanika had been allowed to sell each ton of crushed stones to the contractor (with contractor meeting the cost of crushing the rock) for just $1 (about sh3, 700), he would earn over sh3.3b from just 900,000 tons. Then, if a Ugandan contractor had been allowed to break the rock to the required standards and sell each ton of aggregate to SBC for only $5, he would earn over sh16.6b from 900,000 tons.

That would translate to over sh33b if each ton is sold for $10 by the local contractor. The Chinese contractors such as China Communications Construction Company (CCCC) limited, which is building the Hoima-Kakumiro-Kagadi, sells a ton of aggregate to the Ugandan sub-contractors working on its projects for $14. The Ugandan contractors are using the aggregates to build concrete structures on the same oil roads.

In order to appreciate what informed the decision of the main contractors to hire foreign subcontractors, some linked to (contractors), it is important to look at the sources of the loans being used to build the oil facilities.

First of all, the works and transport ministry and Uganda National Roads Authority (UNRA), opened tenders for the airport and majority of the critical oil roads only to companies from UK and China. This was a condition from the countries that are providing the loans for airport (UK) and the roads (China). China is funding the construction of about 500km of roughly 700km of the oil roads.

"It is not only the loan conditions. It is much more than that," an official from one of the Chinese companies, said.

Pass the local content law

Dr. Lawrence Bategeka, a senior economist and Hoima municipality MP, said while the 40% target is desirable, it might be hard to realize it now due to inadequate capacities and competences in some fields and absence of a local content law.

"The Local Content Bill has not been passed into law. I know we have regulations but they are not as strong as the law and how binding are they? Wherever natural resources are exploited the challenge always stems from benefits sharing," he added.

The legislator, however, said there would several avenues through which Ugandans could tap into the petrodollars, for instance, through supply of goods and services. He noted that Uganda has not attained the required capacity and numbers required by the oil industry although more welders are being churned out by the Uganda Petroleum Institute in Kigumba and other institutions under international accreditation arrangement.

"It is true that technical jobs will be for foreigners. I do not know if we have a Ugandan with requisite capacity to be a project manager for the construction of an international airport built by an international company." Bategeka noted.

The local content policy for oil and gas requires that 40% of the contracts be awarded to Ugandans. The China Railway No.5, which is upgrading the Bulima-Kabwooya section of the Kigumba-Kyenjojo road, one of the oil roads, hired 19 acres of land from a family in Kihooko village, Buhimba sub-county in Kikuube district, for sh65m. The sh65m payment the family received for 19 acres translates into sh1.15m for each acre (according to the local land rent rates) for three years if the value of the rock is not factored in.

"I think the company is renting our land cheaply and then taking out the aggregate free of charge," Thomas Kato, a member of the family, said.

The China Communication Construction Company, which is building the Hoima-Kakumiro-Kagadi road, paid sh50m to Joseph Birungi for leasing his estimated 10 acres of land to crush rocks.

The land is located in Mugarama village in Buyanja county, Kibaale district. The company also leased about five acres from Sunday Godfrey in Kisojo village in Bugangaizi West, Kibaale district, for sh63.9m.

"The stones they have taken out can build several kilometers of a road. But what did I get for my land and the rock? It seems they only leased my land without the rock, which is the most important," Sunday explains.

While the companies indicated that the purchase of stones from the local market will constitute between 20% and 30% of the value of the contracts, it could actually be 5%, according to some industry analysts.

The roads authority said earlier that it does not treat what it describes as the critical oil roads differently from other (roads) in the transport network under its control.

"We call them critical oil roads because the Government set a target to start oil production," the authority's media relations manager, Allan Ssempebwa, said.

The works and transport minister, Monica Ntege Azuba, said probably Ugandans need to be sensitized to be able to understand the existing local content legal framework so they do not sign contracts that should not deprive them of opportunities.

"Landlords in this case have agreed and signed the contracts. The landlords would be able to earn more if they were the ones supplying the stones," she added.

The vice chairman of the Association of Uganda Oil and Gas Service Providers, Denis Kamurasi, says stone crushing activities are supposed to create job opportunities and local content benefits.

"Stones are one of the major construction materials that are going to be needed. They need millions of tons," he noted.

Kamurasi said the airport and roads ought to be considered together with other oil and gas petroleum industry infrastructure because they are being established to facilitate oil production. The aggregate constitutes a substantial component of the construction materials on oil projects.

Local content bonus

However, Kamurasi, said Ugandans could retain a substantial part of the oil money through employment and contracts on upstream petroleum projects.

"We are going to have 70% of the employees on these projects being Ugandans," he added. Kamurasi explained that subcontractors with the highest local content propositions will get contracts.

This, he noted, will motivate local and foreign subcontractors to expand local content benefits. The companies will the highest local content propositions will be established by evaluating their technical and financial proposals. "Contractors with the highest local content propositions have a 10% bonus. This means they would be given free points and that would make them more competitive and then get the contract," Kamurasi said.

Robert Kasande, the permanent secretary at the energy ministry, said capacity has been built for Ugandans to supply goods and services. "We have trained Ugandans on how to make winning bids and strategies to raise finances and how to adapt the health and safety environment and get into joint ventures," he added.

Kasande said Ugandans with relevant capacity are free to compete for contracts beyond ring-fenced goods and services. "They can build well pads, roads in the camps and facilities to extract water from the lake," he added, "We are now going to drill 500 wells but we drilled 100 during the first exploration round. There is more money,"

Ramathan Ggoobi, a senior economist said Uganda has trained people in areas that are not required by the industry. He added that the ones who have received training in fields required by the industry have not worked to acquire the requisite experience.

"They have trained people in legal, monitoring and evaluation, and human resource managers. Those with the requisite academic qualifications have not worked anywhere and these companies will not take chances," Ggoobi explained.

He said Uganda may not earn the targeted 40% of the oil projects money, and wonders if it's true that Ugandan goods and services suppliers and workers really earned 28% of the money spent by oil firms during the first exploration round.

Even when the local content law is in place, Ggoobi, noted it may not be implemented because of the "unwillingness" and vulnerability of Ugandan law enforcers to compromise.

A legal expert, who asked to remain anonymous, said the roads and airport are direct upstream projects and are not linked to the oil industry by the petroleum laws. "That was an oversight on our part, but I think direct petroleum projects would not suffer from similar challenges.

Expatriates have to be paid well because they have trained for a long time to get the experience they have and some have relocated families to work here," he added. However, the SBC spokesperson, Amos Muriisa, denied the findings. "Have you seen our payroll? That information is not correct. I am not in position to comment on that matter now," he added.

From what is happening on the roads and airport project, it is clear that claims of inadequate capacity, terms of contractors and funders and limited experience among the Ugandan labour force, would continue to cut into local content benefits in the oil industry.