Safe transactions to enhance financial inclusion

Dec 04, 2018

The banking sector is to drive adoption and usage of digital payments, they must then build safe and secure systems. These range from products that secure individual transactions, such as tokenization and biometric authentication, to products like the national fraud service.

In the banking sector, people need solutions that provide safe and secure transactions. Therefore, strategic innovations and partnerships have become more essential to provide consumers with services that meet their needs.

For example, scaling digital payments helps to drive financial inclusion and inclusive growth in Uganda.

While celebrating their 50th anniversary, Housing Finance Bank launched new innovations in the payments space.

At a dinner held on November 28, 2018 at Serena Hotel in Kampala, the bank in partnership with MasterCard launched the MasterCard Debit and Prepaid Cards for its (Housing Finance Bank) customers.

These will ensure safe and secure transactions.

Adam Jones at the dinner

Adam Jones at the dinner

The Mastercard's head of Commercial products in Middle East & Africa, Adam Jones noted that new card products can be used in Uganda and around the world either physically or online.

"Together, we are committed to educating consumers about the benefits of using digital payments over cash," he affirmed adding that each collaboration that brings this technology into the hands of consumers helps them to realise their goal of a cashless society.

On the other hand, the cashless payment solutions also underpin the Government's National Financial Inclusion Strategy 2022, which is aimed at financially including 95% of the country's population.

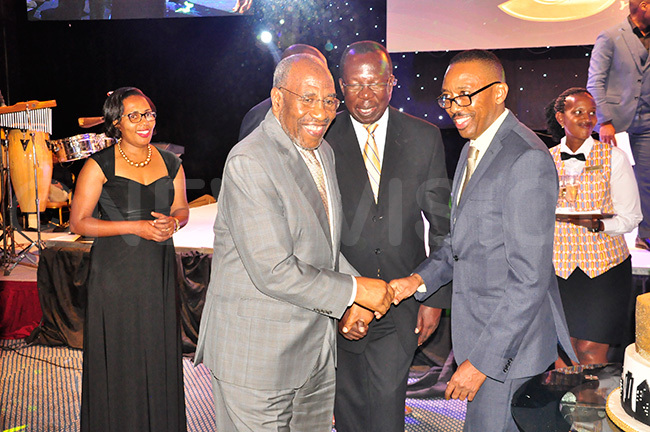

Rugunda with the acting managing director of Housing Finance Bank, Michael Mugabi. Photos/ Ritah Mukasa

"Mastercard is committed to helping the country meet its goals of financial inclusion as set out in Uganda's Vision 2040," Jones emphasised.

He added that if the banking sector is to drive adoption and usage of digital payments, they must then build safe and secure systems.

These range from products that secure individual transactions, such as tokenization and biometric authentication, to products like the national fraud service.

The fraud service provides an umbrella of security over an entire country's payment system, helping to prevent catastrophic fraud.

"As a global network, we have a real-time view of any attacks happening around the world and can then translate them immediately to improving security for you," he assured.

The prime minister led other dignitaries to cut the cake

The prime minister led other dignitaries to cut the cake

Besides, they have targets for financial inclusion and aim to bring 500 million people into the formal economy by 2020.

Meanwhile, the dinner, which was officiated by the Prime Minister, Dr Ruhakana Rugunda was well attended by ministers, members of parliament, members of the Housing Finance Bank board of directors, bank's senior management led by the acting managing director Michael Mugabi and acting executive director Peace Kabunga, customers and staff, among others.

Rugunda, who has banked with Housing Finance bank for the last 20 years appreciated the partnership and upheld the role of technology in driving inclusive growth.

Mugabi noted that the bank which started in 1967 has gone through challenging times to offer housing finance solutions to Ugandans.

"We have grown to 17 branches and 20 ATMs spread across the country. And with this partnership with MasterCard, we anticipate rapid growth," Mugabi added.

The acting managing director at Housing Finance Bank, Michael Mugabi delivering his speech

The acting managing director at Housing Finance Bank, Michael Mugabi delivering his speech

Access to decent housing

During the dinner, the chairman, board of directors at Housing Finance Bank, David G. Opiokello, said that the bank started off as a non-Banking credit institution focusing on providing mortgage finance for residential houses.

However, 40 years later in 2007, the company received its commercial banking license from Bank of Uganda to carry on business as a financial institution under the financial Institutions Act No.2 of 2004.

When the Bank was incorporated in 1967, it had one major mandate: to provide affordable housing finance solutions to all Ugandans. Since then, it has not only provided housing, but also, expanded its customer value proposition through a number of initiatives.

"Our clients have entrusted us with their dreams, saved with us, bought or built first homes and many others through us," Opiokello stated.

He added that others have raised children and educated them on the value of financial propriety through the bank just like many who are building and servicing businesses through Housing finance bank.

"To this end, our commitment to these housing sector initiatives over the past 50 years is demonstrated by the bank's share of over 60% of the residential mortgage market in the country," he asserted.