Juma Kisaame: Man with skill of turning around businesses

In his vocabulary, low sales, slumping profit margins and negative cash flows do not exist.

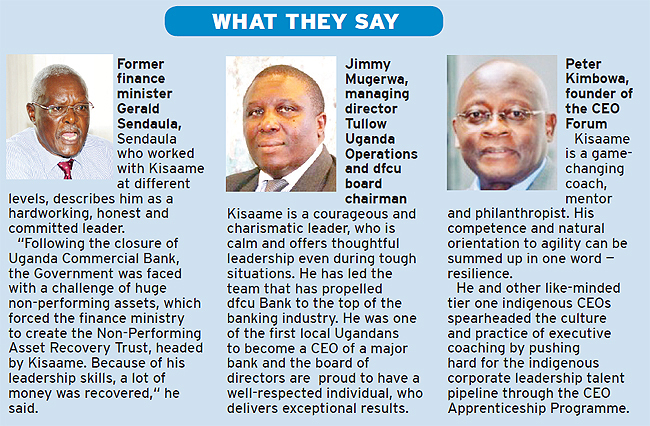

PIC: For 11 years, Kisaame has been at the helm of dfcu Bank as CEO

BANKING

Even as a young boy, Juma Kisaame always wanted situations that challenged him, because they could trigger him to think of how to overcome them.

Little did he know that his desire to face challenges and devise ways of solving them was a training ground that would bring out the leader in him. Thus, it is no coincidence that he has turned around several institutions that were on the verge of collapsing and breathed life in them.

In his vocabulary, low sales, slumping profit margins and negative cash flows do not exist.

And for the 11 years, the 55-year-old Kisaame has been on the helm of Development Finance Company of Uganda (dfcu) bank as a chief executive officer, the results are evident. He has successfully driven the bank from the 11th market position in 2007 to second currently, thanks to his leadership skills.

Career journey

Kisaame's banking career dates back to 1988, when he joined Uganda Development Bank as a trainee accountant. The then enthusiastic graduate of a bachelor of commerce from Makerere University worked his way up through the ranks to become the bank's senior account.

In 1992, he joined dfcu, the holding company, as a senior accountant, a position he held for two years, before he was promoted to manager finance in 1994. Two years later, he was to be promoted to the position of manager finance and administration in charge of the then non-performing asset recovery trust.

Because of his aggressiveness, hard work, commitment, good leadership and problem-solving skills, Kisaame was then parachuted to the position of general manager of the then struggling Uganda Leasing Company (dfcu Leasing), a subsidiary of dfcu Limited in 1998, a position he held in until 2003.

Although the Leasing Company had been established in 1994, it was struggling to get a foot in the banking industry in terms of popularising leasing.

When he took on the mantle, Kisaame reorganised the company and turned it around into a profitable business. He did that by putting in place a strong team, mainly comprising young graduates from university, enhanced training and co-operation from the then group managing director.

"We are the bank which introduced leasing and I was part of the team that revolutionised the leasing industry in Uganda. We stood in the gap, especially for sectors that were in dire need of equipment, such as the transport sector," Kisaame recalls.

dfcu Bank staff take part in a tug of war during the banks gala

Kisaame recalls that the first lease transaction was a printing press to Vision Group in 1998.

The other early beneficiaries were transport companies, such as Jaguar and Gateway Buses.

Leasing has since become a major financing option for many companies and businesses in Uganda looking for flexible financing options to enable them cut costs and keep up with the rapid technological advancement.

In 2003, Kisaame crossed the border to Tanzania, taking on a new role of chief executive officer at the then Eurafrican Bank (now Bank of Africa), Tanzania, a position he held for three and a half years until October 2007.

Not even the bank's consistent loss making position scared Kisaame, given that he had previously led dfcu leasing through a similar nail-biting situation to a profitable position.

And, indeed, he did not disappoint; he cut the bank's huge operational costs and instituted many other changes that saw the bank's health indicators improve from negative to positive.

Records show that during the period, the bank improved its ranking from 27th out of the 38 banks in 2003 to the ninth position out of 42 institutions, new products were added and the bank grew in terms of branches, balance sheet, customer numbers and staff.

|

Journey back home

|

What makes him tick

Kisaame says it takes an entrepreneurial mindset for one to be able to turn around an ailing institution into a profitable one.

"I like seeing things change: I am never satisfied with the status quo. Challenges excite me, because I want to see change. That is what happened in the leasing company; it had been in existence for a number of years, but it was making losses, which was eroding capital. When I took charge, it became profitable within two years," he says cheerfully.

"But you need to have an entrepreneurial mind to sense the opportunities and grab them. However, it also takes a supportive board and team to achieve what you set out to achieve."

Kisaame explains that the main reason companies struggle is because of leadership challenges.

"Being able to get everybody realise that this is the best for the institution and it benefits all, is not easy, but you must face challenges head-on."

Additionally, he says his finance background also helps him to easily see what drives value and focus resources to achieve it.

Banking industry sold

Kisaame says banks can collaborate more by sharing facilities such as ATMs

Kisaame says the banking industry today is at its best in terms of all healthy indicators, noting that all banks are wellcapitalised with core capital averagely estimated at 21%.

This is well above the 10% required by Bank of Uganda. He notes that industry non-performing loans and assets (NPLAs) average has also declined to 6%, which requires little provisioning, meaning that the provisioning is little and that lending rates have also reduced considerably to about 20%.

NPLAs are the sum of borrowed money upon which the debtor has not made the scheduled payments for at least three months and is considered a possible default. To drive costs down, Kisaame says there is need to enhance collaboration among banks by using shared facilities, such as automated teller machines (ATMs) and agent banking platforms to reduce operational costs.

"The cost of intermediation has always been a challenge in the industry, especially for small banks due to lack of economies of scale, which can only come when you are big," he says.

He cites the high cost of digitisation, especially if one is to put in place a good core banking system to drive operations and provide online banking. Additionally, he says there is need to promote a cashless economy to lower the cost of handling cash.

During his tenure, dfcu has made great strides in digitising the bank. It recently upgraded its core banking system to Finacle 10, from Finacle 7, giving it more scalability, agility and security as a basis for expansion, innovation and increased automation of end-to-end customer journey.

It has also installed an auto reconciliation system, which he says has reduced human contact and thus errors. The bank has also launched a quick banking — a digital banking platform, both for the corporate and retail customers.

Challenges

Among the key challenges is the fast pace of the digital evolution, which he says many CEOs are finding challenging.

"If you are at the CEO level, you have to be able to predict the future in order to make right decisions now. Some decisions should have been made about two years back, but are being made a little late because of failure to read the future very well, especially with digital transformation," he says.

Kisaame, with close to 30 years of banking experience, is convinced that when his banking career comes to an end, he has gained a wealth of knowledge in banking and leasing, which he will use to write books to be used as a reference point for future generations.

He also plans to venture into private businesses upon retirement.