NSSF declares 11% interest rate for 2018/19

This new rate will be calculated and credited on the balance outstanding on the members’ accounts as at July 1, 2018.

NATIONAL SOCIAL SECURITY FUND

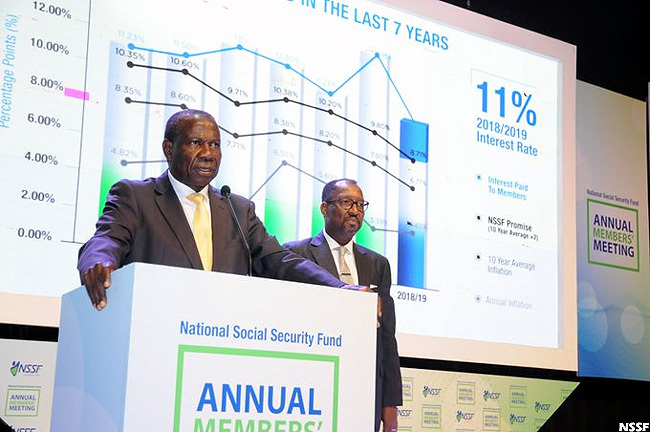

KAMPALA - The National Social Security Fund (NSSF) has declared an 11% interest rate to all its members for the financial year 2018/19, lower than the 15% of the previous year.

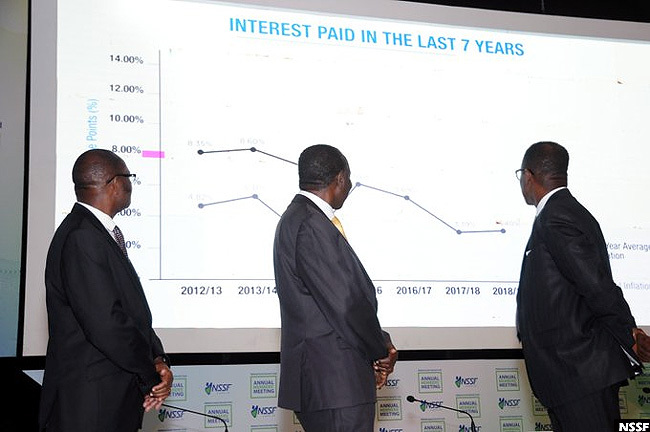

Minister Kasaija announced the new NSSF interest rate. (Credit: NSSF)

Minister Kasaija announced the new NSSF interest rate. (Credit: NSSF)

The announcement came Friday during the fund's Annual Members Meeting in Kampala.

In accordance with provisions of the NSSF Act, the new rate will be calculated and credited on the balance outstanding on the members' accounts as at July 1, 2018.

The relatively lower interest payout was announced by finance minister Matia Kasaija, who told members that it is a "very competitive rate".

He backed this up by saying it is higher than 6.7%, the 10-year average rate of inflation.

"It is also higher than the annual inflation of 3.4% recorded last financial year," added the minister.

Calling it a "real return" and thanking the NSSF hierarchy for ensuring that members' savings are preserved, Kasaija promised that Government will "deliver a conducive macro-economic environment so that the NSSF and many others can excel".

The interest rate for the FY 2018 /2019 is 11%. This new rate will be calculated and credited on the balance outstanding on the members' accounts as at 1st July 2018, in accordance with provisions of the NSSF Act. pic.twitter.com/WJFKqWS2MJ

— NSSF Uganda (@nssfug) September 27, 2019

NSSF board chairman Patrick Kaberenge said the interest payment to members is "very reasonable within the given circumstances".

"The media reported that the Fund has registered a loss of sh402b, this is unrealized loss, which will change when the markets improve," he said.

The NSSF law

Meanwhile, Kaberenge said that while some clauses within the NSSF Amendment Bill are good and need to be adopted as law, others have sparked debate and "will need to be reviewed in order to accommodate members' concerns".

He singled out the following clauses for review:

• Taxation

• Government borrowing

• Mid-term access to voluntary contributions

• Multiple oversight

Earlier this month, the fund's executive director, Richard Byarugaba, told members during a media dialogue to expect a lower interest rate this time round.

In 2017/18, members enjoyed a record interest rate of 15%, thanks to the fund's improved performance on all financial and investment indicators.

But 2018/19 was a "difficult year", said Byarugaba then. Nonetheless, a 13.6% growth rate was realised.

Byarugaba told members that going forward, the NSSF Bill's priority areas are expansion of coverage, adequency and relevance to members through mid-term access.

___________________________

NSSF 2018/19 PERFORMANCE

Contributions grew

There was 17% growth in contributions collections from sh1.049 trillion to sh1.208 trillion, attributed to growth in the economy, which increased the new members registered.

Assets increased

The fund's assets under management increased by 13.1% from sh9.98 trillion to sh11.3 trillion at June 30, 2019. The growth was mainly driven by increased contributions and interest income.

Economy grew

The country's economy witnessed stable growth at 6.1% compared to 6.2% in the previous year. This was supported by an accommodative monetary policy stance, improvement in the agriculture sector because of favorable weather conditions.

Inflation

Inflation closed at 3.1%, lower than regional comparators, and bringing the 10-year moving average rate from 7.16% to 6.28%.

Bond yields

Long-term bond yields dropped, with 15-year bond moving from 17.75% at the beginning of the year to 15.85% at the close of the year. This resulted in an overall positive impact on private sector borrowing.

Shilling appreciated

The shilling appreciated against major foreign currencies, including the Kenya shilling, where most of our foreign-based holdings are.

EA stock markets hit

The East African stock markets suffered significant losses in value. The NSE lost 14%, the USE lost 10% in Uganda and Tanzania plummeted by 21%. Other factors such as policy uncertainty and slowed economic activity in Tanzania exacerbated the sell offs. Further concerns around rate caps in Kenya, widening deficit and fears around an overvalued currency multiplied the negative sentiment in the region.

Customer satisfaction dipped

Customer satisfaction slightly dipped by 1% from 85% in 2017/2018 to 84% in 2018/2019. The key factor affecting the rating is limited product offering, which the fund hopes to address through the proposed amendment to the NSSF Act.

Benefits

The amount of money paid in benefits increased by 25% from sh360 billion in 2017/2018 to sh450 billion in 2018/19.

Administration

The cost of administration improved slightly from 1.31% in 2017/2018 to 1.28% in 2018/2019, with the cost-income ratio remaining flat at 11.6%.