1994/95 budget presented by Mayanja Nkangi to the NRC

The following is the full text of the 1994/95 budget proposal presented by Minister of Finance and Economic Planning, Me. Jehoash Mayanja Nkangi to the NRC.

The following is the full text of the 1994/95 budget proposal presented by Minister of Finance and Economic Planning, Me. Jehoash Mayanja Nkangi to the NRC.

ECONOMIC PERFORMANCE 1993/4

I want to begin by highlighting some of the key developments in the economy during this past year. First of all, it is important to recognize the impact of drought.

In an economy so dependent on rain-fed agriculture, it is inevitable that adverse weather conditions have a major impact on economic performance, both in depressing output and incomes and inputting upward pressure on food crop prices, which represent such a large proportion of our consumer price index.

Drought has suppressed our growth in 1993/4 to around 4% while at the same time, the estimated 40% increase in food crop prices over the year has been the main factor pushing inflation to an estimated 19% for the year.

In spite of the adverse circumstances in agriculture, other sectors of the economy have fared well in 1993/4.

Industrial production rose by 19% in the calendar year 1993 and the latest estimates which I have indicated the continued growth of 15-17% for 1993/4.

The agricultural sector has grown by 1.7% in 1993/4 while manufacturing has grown by 15.1%. Export of goods and services have shown considerable improvement, with 37% growth overall.

Coffee receipts grew by 61%, while strong performances are also recorded for tea 931%0, cereals (99), fish products 942%) and beans (59%).

Excluding food crop prices, the consumer price index has increased by 10% in the year to May 1994, compared with 0.2% in 1992/3.

Measured on this basis, the underlying rate of inflation has been stable for more than a year, fluctuating with the range 8-12% on an annual basis since April last year.

By excluding food crop prices, we focus more closely on the outcome of stabilization policy. Average inflation during 1993/4 was 6.6%. The steady and low rate of underlying inflation is a clear testimony to success in macro-economic policy.

In view of the problems of drought this past year, we need to consider options for reducing instability in food production. The government will investigate possibilities of promoting cost-effective irrigation including the development of valley dam irrigation schemes.

Drought has not been the only shock to our economy this year. A particularly striking development I 1993/4 has been the emergence of strong market pressures increasing the value of the Ugandan shilling against the US dollar and other foreign currencies.

Now, set against the history of the shilling depreciating by 94% over the past 8 years, the 22% increase in the dollar value of the Ugandan shilling since December 1993 must be viewed as a relatively modest adjustment.

However, the sudden reversal of expectations of continued depreciation has taken many by surprise and several exporters have found difficulty in adjusting to the reduced shilling value of their export proceeds.

Several of the factors which led to this strengthening of the shilling are entirely desirable in themselves.

For example, increased availability of suppliers' credit has temporarily suppressed demand for import finance in recent months reflecting the increasing credit worth of the Ugandan economy.

The strengthening of the coffee price is also much to be welcomed. The coffee sector has also benefitted from the increased flow of foreign exchange into the market. More generally, the strengthening of the market reflects growing confidence in the economy and a greater willingness to hold Ugandan shillings.

However, the fact that the recent appreciation is in large measure a problem of success and favourable world prices does not make it any less of a problem. But while many have pointed out the disadvantages of a strong shilling, very few have suggested coherent strategies to address the present situation.

I have heard it said that the problem stems from "too few shillings in the market" with the implication that by printing more money the problem would be solved.

This amounts to a recommendation that government should call on increased inflation to bring up our appreciating shilling.

I am sure that members of this council are under no illusion that such a policy offers a viable way forward for this economy. We already face a situation in which strong inflationary pressures have been contained only with continued tight restriction of government expenditure.

To put our policies in reverse would be to unravel the gains that have been made so far in attaining economic stability and establishing an environment for investment and growth. Renewed inflation would rapidly eat away the very incentives which we wish to enhance.

I believe that our response to the strong shilling must build on the policies we have followed up till now.

In 1993/4, we have so far moderated exchange rate movements by permitting the central bank to absorb a higher volume of foreign exchange into reserves than planned, offsetting this with savings from the government budget in order to avoid excessive monetary growth.

Government will continue to exercise a moderating rate in the coming year as required. Nevertheless, I must make clear that the government has not and will not attempt to hold the market to any predetermined exchange rate.

To attempt to use intervention to maintain the desired level of the exchange rate is the equivalent of a reversion to a fixed exchange rate.

Uganda has successfully operated a floating exchange rate for nearly four years. We do not intend to reverse that policy now.

In order to institutionalize the liberalization of foreign exchange regime and to send strong signals to the currency markets that government is determined to pursue macro-economic policies that will guarantee the international convertibility of the shilling, on April 15th this year, Uganda accepted obligations of Article VIII sections 2,3 and 4 of the articles of agreement establishing the International Monetary Fund.

By attaining Article VIII status in the IMF, Uganda accepts that we will not place any restrictions on transactions on the current account of the balance of payments. This makes other countries to accept the shilling as convertible currency internationally.

However, I would also like to make the following points for the comfort of those hard pressed by the strong shilling.

Many of the factors underpinning the present strength of the shilling are likely to be temporary. Without claiming to predict the future path of the exchange rate in detail, I am confident that some of the present upward pressures on the rate will soon be reversed.

The banking system has taken a while to adjust to the new circumstances of the new interbank exchanges, which has at times exacerbated the volatility of the exchange rate movements.

I expect the banking sector to make a greater contribution to stability in the future as the market deepens and experience of the new arrangements develops.

The experts in the Agricultural secretariat of the Bank of Uganda have been requested to regularly study and update the costs of crop production of the main export crops at various levels of exchange rate. Their most recent study finished only this week shows that farmers of the main exports are receiving adequate remuneration at current exchange rates and world market prices.

For example, for robusta coffee, the breakeven price for the marginal former i.e. the least efficient farmer is shs340 per kilo.

Farmers of robusta coffee are currently receiving pricing ranging shs450 to shs750 per kilo depending on the location.

Similarly, the breakeven price for Arabica coffee for the marginal farmer is sh430 per kilo of parchment. Arabica farms are currently receiving prices ranging from sh600 to sh800 per kilo depending on the location.

Moreover, the benefit/cost ratios, as measured by the Net Financial Benefit Ratio which shows whether it is profitable to export a particular commodity, indicate that all exports, except cotton, are eminently profitable.

When the net benefit ratio exceeds one, the export of the commodity is profitable, when it is less than one it is not.

The excess over one show percentage benefit over and above cost. At an exchange rate of sh940 to one US dollar and at the prevailing export prices, net benefit ratio for traditional robusta coffee is 1.74 while clonal robusta coffee is 2.06.

The ratio for Arabica is 2.11. For tobacco, the ratio is 1.09 for the flue cured tobacco and 1.02 for fire cured. For tea, the ratio is 1.03 for out grower tea and marginally lower at 0.99 for estate production. For maize grown for the regional market the ratio is 1.1 while for rice it is 1.09.

In the case of cotton I will shortly be announcing a programme to reduce the cost of production to make cotton exports competitive once again.

External sector developments

Reflecting the significant progress achieved in the foreign exchange and external trade systems, the current account deficit excluding grants declined from 11.7% of GDP in 1992/3 to 8.8% of GPD in 1993/4.

The current account deficit including grants also continued its downward trend, falling from 3.35 of GDP in 1992/3 to 2.2% of GDP in 1993/4. This improvement occurred in spite of the fact that annual official grants from donors ……..

Drought has not been the only shock to our economy this year. A particularly striking development I 1993/4 has been the emergence of strong market pressures increasing the value of the Ugandan shilling against the US dollar and other foreign currencies.

…… decreased by 1.9% of GDP between 1992/3 and 1993/4.

The overall balance of payment deficit has declined sharply in recent years, falling from -$119.4m in 1991/92 -$41.4m in 1992/3 before turning into a surplus of $41.2m in 1993/4.

Another very welcome development this past year has been the further downward movement of interest rates. The Treasury bill rate now stands at 11.3%, a full 12.5 points lower than this time last year. Two main factors have brought this about. Firstly, the government has been cautious in its own borrowing, achieving substantial net repayments to the banking system during the course of the year while making only prudent use of the Treasury bill instrument.

Secondly, it is clear that the domestic market has reduced its expectation of future inflation as the achievement of economic stability last year has been consolidated, and confidence in Uganda government paper has improved.

Measured against the project level inflation, the current Treasury bill rate represents a modest real rate of interest which should offer no obstacle to healthy growth in private sector investment.

It is now vitally important for our economy that the banking sector follow the lead set by falling Treasury bill rates and ensures that costs are cut and lending rates reduced to fuel strong growth in investments.

Monetary growth in 1993/4 has been higher than programmed but the good news is that supply came from the productive sector of the economy, namely commercial bank lending to the private sector and sharply improved external sector performance which led to higher than expected growth in net foreign assets.

In order to avoid any risk to our anti-inflation strategy, it was necessary to accommodate high growth in net foreign assets with more restrictive policy elsewhere. In principle, such adjustment could have been made either in credit to the private sector or to government.

In the event, the government bore the adjustment by increasing its savings in the banking system, while credit to the private sector has increased by 26.4% in 1993/4.

Cotton revived

The revival of cotton production is essential for several reasons. First and foremost, cotton growing was a major income earning activity for thousands of peasant families, particularly in the North East of our country. So, the revival of cotton is an important part of our strategy for poverty reduction.

Secondly, cotton production will provide inputs into the textile and oil industries and thirdly, it will increase foreign exchange earnings through export of lint and by-products.

The government believes that an efficient ginning industry is a prerequisite for the revival of cotton production.

At present all but four or five of the eighteen cooperative unions involved in cotton ginning are insolvent or nearly so. A prime cause is the heavy burden of debt that they ow to the Cooperative Bank, Uganda Commercial Bank and Lint Marketing Board.

The bulk of the debt was incurred for the purpose of rehabilitating the ginneries but in most instances, the work was never completed. LMB is also indebted to foreign buyers of cotton for failing to honour supply contracts.

The management and financial difficulties of the union and LMB led to a complete erosion of the two key factors responsible for the rapid expansion of cotton output namely ease of marketing the crop at village level and reliability and promptness of payment.

Our aim is to improve and institutional framework relating to cotton production, ginning and marketing. To this end, the NRC enacted in January 1994 the Cotton Development Act which among other things abolished the LMB's monopoly over exports and unions monopoly over ginning.

We are also taking steps to create the right conditions for the emergence of ginneries which are under competent management and are controlled by creditworthy operators.

We will, if requested, provide the union with technical assistance in preparing a business plan designed to restore financial viability within the medium term.

Based on acceptance business plan, the government would agree to substantially write down the union's outstanding debt, subject union meeting certain benchmarks.

The unions' part of the bargain is that it must enter into an agreement with private entrepreneurs on its business plan and secure credit as needed from a commercial bank.

The debt relief program is essential on reviving cotton production as the insolvency of the majority of ginneries represents a major bottleneck in the cotton production and marketing chain.

By writing down the loans the government will give unions or new potential owners of the ginneries a chance to restore viability. We have notified the unions and the creditor banks of the proposed arrangements for debt relief and ginnery reconstructing.

The unions interested in participating in the scheme and the banks have signalled their acceptance of these arrangements.

In the meantime, we have taken stock of the debt owed by each union and agreed on modalities for debt relief with the union and creditor banks. To this end, we will seek NRC formal approval to grant debt relief to cooperative unions.

Although Uganda is a net exporter of food, famine has hit part of the country this year. To help alleviate this, the government has during the past year given small grants to farmers in distressed areas.

For the future, however, ensuring proper food security is critical to the wellbeing of the population. Government's primary role in this area will be to help develop primary storage at the farm level.

Education and extension programs will educate and encourage small farmers to store surplus stocks whenever possible and encouraging the development of local cost-effective methods of trapping rainwater for irrigation during drought.

Further, because people in the north and east have been short of food while stocks in other parts of the country have sometimes been enough to help these people, the government will seek to improve transport and information flows between districts.

This will involve the further development of our road network, especially secondary and tertiary school as well as significant extension work.

In the medium term, the government is committed to ensuring improvements in seed quality and agricultural technology which will enable the country to produce more food, more reliably.

The key to future food security is in the villages; we must encourage the development and maintenance of well-located storage at the primary level.

THE 1993/94 BUDGET

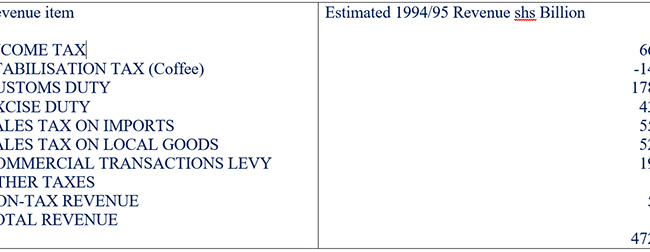

The budget out-turn for the fiscal year ending June 1994 is as follows;

Total revenue and grants are estimated to be at Us668b, representing a 2.5% increase over the levels budgeted in June 1993. This …………

Government has decided to open a new embassy in South Africa and reopen another Japan. These additional expenditures will be accommodated by accelerated closure of other embassies abroad.

…….was in the most in most part due to a 5% over performance in project and import support grants, amounting to Ush280b compared to the budgeted Ush266.3b. Tax revenues amounted to Ush363b, about 1% lower than budgeted, on account of lower import duties on petroleum.

This was due to the impact of the appreciation of the exchange rate but this was made worse by a decline in the price of imported petroleum products.

Non-tax revenues performed poorly. These revenues are mainly composed of appropriations-in-aid collected by government ministries. The non-tax revenue outturn reflected a 23% shortfall compared with a budget which is a cause for concern.

On the expenditure side, total outlays amounting to shs847b were close to the target. Development expenditures were 1% above expected levels at Ush425b largely on account of higher levels of external assistance.

Recurrent expenditures were, however, lower than programmed at Ush419b.

The overall budget deficit improved significantly both over the previous fiscal year and the planned level. As a percentage GDP, the overall deficit including grants was 4.3% of GDP, vis-à-vis a target of 5.5%.

Excluding grants, the overall deficit amounted to 11.3% of GDP against a target of 1.6%.

This year, for the first time, the government succeeded in eliminating the reliance of government on Central Bank borrowing which fell from the equivalent of 4% of GDP in 1986/87 to repayment to the banking system equal to about 1.0% of the GDP in 1993/94.

The 1994/95 budget forecast

The 1994/95 budget is based on the attainment of a further revenue effort with the share of GDP rising from the current position of 9.6% in 1993/94 to about 10% in 1994/95. This represents a collection of Ush472b in tax and non-tax revenue.

Given the declining dependency on external assistance, grants are expected to contribute less to the budget than before, at Ush193b in 1994/95 compared to Ush280b in 1993/94.

Total expenditures are programmed at Ush857billion of which 457billion is recurrent and 398billion is developed expenditure.

In the development programme, ush329b of expenditure will be externally funded and ush69billion will be domestically funded. Of the recurrent budget, ush125b is to be spent on the wage bill, ush58billion on interest payments and ush256billion on non-wage recurrent expenditure.

About ush17.3billion is budgeted for transfers to the Uganda revenue authority and ush13.1billion is programmed for the payment domestic arrears. External debt service is estimated at US$110million.

The overall deficit excluding grants is estimated at Ush191billion, representing 7.9% of the GDP compared to 11.3% of GDP last year. Net financing is estimated at Ush242billion while net domestic financing is estimated at -ush50.6billion.

PUBLIC EXPENDITURE

Salaries and wages

The us89billion allocated to the wage bill in 1993/4 provided for a 37% average increase in wages this year.

I am pleased to report that the good progress which has been made in reducing staff numbers this year generated savings which permitted a further mid-year increase of about 50% on basic salaries.

An allocation of ush125billion to cover wages and salaries of civil service and political leaders including members of the NRC has been made in the 1994/5 draft estimates, representing a 40% nominal increase over 1993/4.

This is consistent with our three-year strategic plan for civil service reform. Given a reduction in the payroll from more than 300,000 in July 1990 to an expected 145,000 for July 1994, the increase in the wage bill will permit further significant progress towards the minimum living wage for the civil service. We hope to achieve payment of the full minimum living wage by 1996/7.

The 1994/5 wage bill allows some provision for monetization of existing benefits in kind, such as transport and housing. In 1994/5, it is anticipated that a transport allowance will be made available in lieu of transport benefits. Proposal for initial steps towards monetization of housing benefits have yet to be finalized and will be announced shortly by the Minister of Public Service.

Other recurrent expenditure

With the recurrent budget, the concept of Priority Programme Areas (PPAs) has been adopted to address the most critical areas of mandatory government services.

Additional PPAs for inclusion in 1994/5 are offices of the Administrator General, Registrar General < Law Reform Commission, Land administration and registration, the Decentralization Secretariat and the Judicial and Public Service Commission.

Overall the 1994/5 budget provides for a real increase of 15% resource for PPAs. Since 1986, about 80% of Uganda's tarmac road network have been rehabilitated at a high cost of over US$300m.

Unfortunately, maintenance of these roads is now due and road maintenance expenditure must increase substantially from below US$15million to between US$30-40million per year over the next four years if the rehabilitated roads are to be preserved.

The donor community has agreed to assist this programme provided the government gradually takes over full responsibility for road maintenance.

The implementation of the decentralization of the recurrent budget started in 1993/4 with thirteen districts and will continue with a further fourteen districts in 1994/5.

The first thirteen decentralized districts are to graduate from a vote to a Block Grant system in 1994/5. As provided by the law.

This will allow these district authorities to determine their priorities and spending programmes for the year within national socio-economic priorities.

For 1994/4, greater attention has been given to making adequate budgetary provision for government's use of utilities with an increase of 127% in total allocation. Similarly, adequate provision has been made to clear outstanding domestic arrears.

However, we also need to address an important matter of budget control in order to avoid the accumulation of domestic arrears in future.

Any unpaid bills verified by the Auditor General and presented to the Ministry of Finance and Economic planning by accounting officers will now be deducted from ministries' current budgets. No supplementary expenditure will be permitted to accommodate such breaches of budget discipline.

Government has decided to open a new embassy in South Africa and reopen in Japan. These additional expenditures will be accommodated by accelerated closure of other embassies abroad.

External debt

The size of Uganda's external debt continues to be a concern. At present, the total debt stock stands at US$2.6billion with arrears estimated at US$248millio.

During 1993/4, the government continued with the implementation of debt strategy, aimed at reducing external arrears and achieving the maximum possible reduction in future debt service.

All Paris Club and multilateral maturities were serviced in full. However, the government has continued to accumulate arrears to non-OEC creditors who do not provide a positive flow of funds to Uganda.

During 1994/95, the government intends to seek further reductions in debt stock for indebted countries which have carried out strong adjustments programmes.

I believe that the improvements in economic management in this country in recent years should justify such relief and I intend to press for more favourable treatment of our case with Paris Club creditors.

Should I succeed in pressing for a substantial reduction of the stock of our debt - say of the order of 80% - Uganda would be the first African country o exit from the Paris Club. That is to say, I would not go back to seek Paris Club rescheduling.

Development expenditure

For 1993/4, total expenditure on the development budget is expected to be Ush425.17billion of which Ush39.8billion has been nationally financed. In 1994/95, the development budget will be Ush395.76billion of which Ush69billion will be locally financed.

Various small entrepreneurs in the countryside are hampered by lack of relatively small credits to enable them to undertake productive or commercial ventures.

This particularly concerns peasants and the youth. Government is providing Ush6billion in this budget for this purpose.

During 1993/94, further work has been done to rationalize the development budget and to establish a core programme of a size which can be adequately funded and successfully implemented. Core projects receive priority in allocation of resources and will constitute the first call on development budget releases during 1994/95.

Parastatal sector

Several measures will be taken to enhance financial discipline in the parastatal sector.

I have indicated already that, for its part, the central government will make adequate provision in the budget for payments for utilities and other parastatal services its debts arising from loans on lent by Ministry of Finance and Economic Planning.

In some cases, there has been some confusion on the terms of such on lending.

In order to clarify this situation, government has decided that financing which has been provided to any parastatal by government, whether directly or as on lending of donor finance, will be deemed to be loan finance, attracting a market rate interest, unless the parastatal concerned can provide documentary evidence of prior agreement to alternative financing terms by all parties concerned.

Considerable progress has been made in recent months towards the effective operation of Kampala Stock Exchange.

We will shortly be launching the stock exchange fully with the sale of government holdings in some prime commercial enterprises. The government has recently identified some enterprises which we will move to divest as soon as possible.

The list of enterprises includes; Barclays Bank, Uganda consolidated properties and Uganda rain Millers Co. Soon the government will conclude discussions with one or two foreign-owned banks in which we have shares to add to this list.

Early in the new financial year, I will present to the NRC a Bill whose purpose is to promote and facilitate the development of an orderly, fair and efficient capital markets industry.

In accordance with existing legislation regarding divestiture of government holdings, the proceeds of such sale of assets must be used to creative assets. So far, specific modalities have not been developed for this purpose. I now purpose that the proceeds of these divestitures will be available to finance long term investment through the banking sector.

The government intends to establish very shortly, along term refinance facility within the Bank of Uganda, which will operate in a similar manner existing Investment Term Credit Refinance Facility and will complement the objectives of that facility and permit more rapid development of new long term domestic investment in this country.

Private investment

Efforts over the past three years to create a favourable climate for accelerated private sector investment are now showing significant results.

The public investment programme, besides providing basic social services, has given special attention to infrastructure and financial sector development, in order to enhance the incentives for private investment.

The progress so far made ………..

The main reason that interest rates have been high over the last few years has been commercial bank inefficiency. A revitalized financial sector will be able to intermediate efficiently between savers and investors

…………..in the privatization programme and in the return of expropriated properties to former owners, has greatly broadened the horizon for private sector development.

Since July 1991, a total of 896 project proposals have been received by the Uganda Investment Authority (UIA) of which 711 have been approved.

By March 1994, 690 projects have been licensed under the Investment Code with a value in proposed investment amounting to date totalling $208.5million and a planned employment creation capacity of up to 23,673 jobs for Ugandans.

Within the manufacturing sector, 175 projects with a total investment value of $159.4millon are already operational. A study is now underway to identify further improvements in the policies to encourage private investment.

Financial sector policies

The restructuring of the Uganda Commercial Bank lies at the heart of efforts to revitalize the financial sector. Several actions are underway;

• A task force has been appointed to examine the required changes in the UCB Act 1965.

• Staff retrenchment and branch closures are being implemented.

• An Operations Management Contract is being concluded with a management consultant firm.

• The Non-Performing Asset Trust (NPART) is presently being established. A management contract will shortly be concluded with an international firm of Asset Recovery experts.

• A merchant bank will shortly be contracted to investigate options for enhancing the competitive structure of the financial sector, including options for early privatization of UCB.

The financial sector has a key role in economic development. The better the financial system is at turning people's savings into productive investments, the faster the economy can grow.

It is therefore of utmost importance of utmost importance that UCB, as the biggest commercial bank in Uganda, leads in effecting sharp improvements in the efficiency of the commercial banking sector.

The main reason that interest rates have been high over the last few years has been commercial inefficiency. A revitalized financial sector will be able to intermediate efficiently between savers and investors without recourse to high-interest rates.

For these reasons, I hope that the restructuring of UCB moves fast to ensure that UCB, and the rest of the financial sector, can truly lead the development of Uganda.

In addition to UCB, attention has also been given to the revitalization of the Cooperative Bank, for which a Restructuring Plan has recently been prepared. A study will also be carried out of options for the future role of the Uganda Development Bank.

The 1993/94 Budget made the necessary changes to the Income Tax Decree (1974) to enable finance leasing of capital goods.

The Development Finance Company of Uganda in conjunction with other shareholders has incorporated rated the Uganda Leasing Company which is now finalizing preparatory work prior to starting up a business in the second half of 1994.

Leasing will provide a much needed alternative source of capital financing for new and growing businesses.

I am pleases to report that the tax treatment of loan provisioning by commercial banks has recently been amended to ensure full consistency with the Bank of Uganda's Regulation on Prudential Norms on Asset Quality.

I believe that this development will greatly encourage prudent management within the banking sector. The details of these arrangements have recently been sent to all commercial banks.

The Bank of Uganda is currently preparing a detailed restructuring plan, which is expected to be approved within the next few months. On the basis of this plan, the government will undertake recapitalization of the Bank in order to consolidate the provisions within existing legislation for the independence of the central bank.

Monetary policies

To further deepen and broaden the financial system, the Bank of Uganda will encourage further development of an interbank shilling money market. In this regard, the Bank of Uganda will soon implement proposals to stimulate interbank borrowing and rediscounts between deficit and surplus banks.

During the past year, the government of Uganda has increased the volume of Treasury Bills issued at weekly auctions. Some secondary trading in Treasury Bills has developed, but we want to see greater progress in his area. A stronger secondary market would enhance the effectiveness of monetary policy and help towards the development of capital markets in Uganda. The Bank of Uganda will ensure that the process of transfer of ownership is quick, simple and transparent.

Treasury Bill certificates will be made "bearer payable" and issued in standard denominations, thereby making the bills more readily transferable. In order to deepen the market, current legislation requiring insurance corporations to hold Treasury bills will be enforced and other public bodies will be encouraged to make greater use of the instrument.

Since 1992, a reference rate based on Treasury Bill rate has been used to set guideline ceilings and floors for commercial banks' interest rates. These guideline rates, in the absence of direct controls on commercial bank activities, have had limited effectiveness.

It is therefore proposed that these guideline rates are abolished from July 1, 1994, with interest rates thereafter fully liberalized environment, the Bank of Uganda will influence interest rates through its liquidity management, as is effectively the case at present.

A number of improvements are planned in the system of cheque clearing. In order to expand clearing services further, the Bank of Uganda will open local clearing to areas serviced by more than one commercial bank. The bank of Uganda intends to open up more upcountry clearing where it is found to be viable in view of the volume of transactions.

Also under consideration is the possibility of opening up regional clearing centres to handle transactions between regions. This will reduce the costs of delivery of instruments from one area to another.

Cheque clearing time in Kampala has been reduced to three days. Efforts are being made to reduce this further to two days in the next financial year. This will require an increase in clearing hours.

In order to enable the Bank of Uganda to carry out its supervisory role effectively, and to improve the information base for monetary policy, the regulations governing the flow of information from commercial banks to the Bank of Uganda need to be tightened.

This has been a particular area of laxity over recent years. The grace period following the due date for the submission of returns will be revoked immediately. Henceforth, penalties will be levied if a return is not submitted. The Bank of Uganda will shortly notify the banks of the penalties that will be incurred for late submission of data.

In accordance with the provision of the Financial Institutions Act, the Bank of Uganda will on July 1, establish a Deposit Insurance Fund to compensate small depositors in case of bank failure.

The initial target size of the fund is Ush2.5 billion. The remaining Ush500 million will be contributed by all commercial banks through annual premiums of 0.2% of deposits.

Contribution to the find by banks is mandatory. In 1996, banks in full compliance with prudential requirements will have their premium reduced. Building societies and other deposit-taking financial institutions will join the fund at a later date.

Following the liberalization of the insurance industry to allow competition between private companies and the government-owned National Insurance Corporation two years ago, the industry has grown rapidly.

At this juncture, it is necessary to enact a new insurance law to regulate the activities of insurance companies. A draft insurance bill will soon be discussed by cabinet before submission to the NRC.

The draft provides for, among other things, the creation of an autonomous Uganda Insurance Commission, which shall establish standards for the conduct of insurance and reinsurance business under the overall supervision of the Bank of Uganda.

Taxation

As a percentage of GDP Uganda's revenue performance has continued to improve but it still remains very low compared to countries with rather similar economic circumstances.

The revenue to GDP ratio improved from 7.8% in 1992/93 to 9.6% in 1993/94. While we have made good progress over the past five years, much remains to be done to put the financing of government expenditures onto a sustainable basis.

The performance of petroleum revenue in 1993/94 was particularly disappointing. The expected revenue out turn from petroleum is Ush93 billion, about Ush16 billion or 15% less than budgeted. This sharp decline was caused by a big fall in all prices internationally, and the appreciation of the shilling.

However, revenue performance was above budget under some other headings, especially domestic excise duties, domestic sales tax and import duties.

Overall, the shortfall in petroleum revenues was fully made up by increases in other revenues.

1994/95 Estimates

For 1994/95, the budgeted revenue total is Ush472 billion or about 10% of the GDP. This estimate takes account of the increases in oil duties, which were implemented on May 17, 1994, and the additional measure measures I am introducing today. Before I proceed to describe the various measures, I wish to make some general comments. The essential elements of the government's tax policy are:

- To increase Uganda's present low revenue to GDP ratio.

- To maintain low tax rates so as to foster compliance and to create a climate favourable for work and investment.

- To simplify the tax code to make administration easier and to facilitate better public understanding of the tax system.

- To improve capacity in tax policy formulation and thus to ensure the orderly development of tax policy and a stable tax regime over the medium term.

- To improve tax administration especially to reduce large-scale tax evasion and to reduce drastically tax exemptions.

- To broaden the tax base.

Value-Added Tax

Government has decided to introduce Value-Added Tax in Uganda with a target commencement date of July 1, 1996. This allows a period of two years for the serious preparation needed to ensure a successful transition to VAT.

This important tax policy change will make the collection of indirect tax more efficient. It will avoid excess taxation due to cascading and it will target taxes better on consumption. The VAT system will replace the current sales tax and the commercial transactions levy.

A VAT implementation unit has already been established. This unit will be guided by a steering committee, consisting mainly of officials from my ministry and the Uganda Revenue Authority.

In the due course, the government will announce important details of the new VAT arrangements, especially the tax rates and the goods and services to be covered by VAT.

However, at this early stage, I can say that we intend to exclude exports from the scope of VAT. The government also intends that the VAT system will yield at least the same revenue as we now get from sales tax and CTL.

The business sector will have an opportunity to be fully involved in the process of changing over to VAT. I will soon be establishing a VAT consultative committee, which will include representation from important groups like manufacturers, importers, exporters, traders and providers of services.

Cigarette Import Ban

The House will be aware that the government has lifted the ban on tobacco imports. The position now is that, instead of a ban, there is an import duty of 60%. This is in addition to the normal excise duty of 100% and a sales tax of 30%, which apply for tobacco products. Because taxes on cigarettes account for a high percentage of total revenues, I will monitor the effects of this change carefully.

Petroleum Taxes

In January last year, the government decided to deregulate oil prices and as a result, pump prices for petroleum products are no longer controlled. Since liberalization commenced, there has been a sharp decline in the cost of our oil imports. However, it is very disappointing to note that the pump prices have not followed the downward pattern of the cost of imported petroleum products.

Members of the House will be aware that our petroleum prices are advalorem, and so the tax yield rises and falls in line with the trend of import costs. Because of the decline in import costs, our monthly revenues from petroleum taxes declined sharply over the past five months.

We increased the excise rates in mid-May, primarily to address the sharp decline in revenue but also to absorb some of the excess margins the oil companies have been enjoying since January.

I would like to see better evidence of competition in the oil market to justify the liberalization policy we adopted last January. If there is no effective competition between the oil companies, and if declines in import costs do not result in lower pump prices, tax policy will certainly have to play a more active role. Indeed there will be a justification for modifying, perhaps even abandon the liberalization policy, if normal market forces cannot operate. I would naturally prefer to see effective competition than to resume regulating prices. For these reasons, the government will continue to monitor developments in the oil market very carefully.

1994/95 Revenue Proposals

I will now turn to the measures I am proposing to raise the additional revenue of Ush47 billion needed in 1994/95.

Stabilisation Tax: The rising price of coffee threatens to exacerbate the current pressure on the exchange rate. Continued appreciation could undermine the viability of other exports, and obstruct our objective to diversify.

Therefore I propose to introduce a graduated tax on coffee exports, which would collect some of the windfall gains when coffee prices are very high.

The yield from the tax could enable Bank of Uganda to purchase foreign exchange in the market and this is some of the pressure on the exchange rates, giving relief to other exporters and producers of import substitutes.

It is proposed that a tax of 20% is levied on coffee receipts in excess of Ush1,100 per kilo. As I have explained above, our experts have been studying the cost of production of all major exports, and they have advised that the price of Ush1,100 per kg would allow producers, processors and exporters a normal return. A higher rate of 40% would allow the value of receipts above and the second threshold of Ush2,200 per kg.

The yield of this tax at a projected price of Ush1,500 per kg is approximately Ush14.2 billion. Members of the House are no doubt well aware of the recent sharp increase in coffee prices internationally.

These are benefitting the entire coffee industry and it is only reasonable that government should be able to have a small part of the big gain while also ensuring that exporters of other commodities are not unduly disadvantaged by the effects of a booming coffee export sector.

I would like to take the opportunity to emphasize that this is a very different sort of coffee tax to that which we have had previously.

We propose to tax only receipts above the threshold. In the past, a combination of a regulated monopoly and implicit taxation through low producer prices and the overvalued exchange rate was a severe burden on the industry. This cannot be repeated.

We have implemented sweeping reforms to liberalize the coffee industry and systems of international trade and payments; we have also ensured that the shilling is a fully convertible currency.

The benefits of these reforms have gone to the farmer. In 1986 when international prices were over $4 per kilo, farmers only received US cents13 per kilo; earlier this year when prices were around $1.20 per kilo, farmers were getting almost US cents 40 per kilo, three times the 1986 price.

By taxing only windfall surpluses, we will ensure that farmers continue to enjoy better incomes and still afford to reinvest in better quality clonal coffee.

I have taken note of representation from the coffee exporters, that introduction of this tax immediately would present considerable difficulties for the industry. The tax will, therefore, be implemented on August 1.

Motor Vehicle License Fees

The Finance Bill will include proposals for increases averaging 50% in license fees for motor vehicles. An important change in the basis for proposing these fees is proposed for 1994/ 95 as follows;

- The fees for motorcycles and private vehicles will be determined by engine capacities; and

- The fees for other vehicles, and for tractors, trailers, engineering plants and other unclassified items will be determined by gross weight.

The main reasons for this change are to make administration easier and to reduce the scope of abuse.

The new fees structure takes full account of the fact that smaller vehicles are causing less damage to our roads, and should, therefore, be charged proportionately less.

It must be emphasized that these increases in fees are well justified considering the urgent need for more spending on road maintenance and rehabilitation.

As the expenditure provisions show, the government is providing approximately Ush5 billion extra in 1994/95 for road maintenance. Apart from this, enormous sums will be spent on rehabilitation and new roads.

The fee increases I am proposing today will generate additional revenue of Ush4 billion, an amount which is considerably less than extra spending on roads.

Vehicle owners can, therefore, feel assured that they will be getting good value for the extra license fees they will pay in 1994/95. Details of the fees and licenses will appear in the Finance Bill.

Excise Duties

Recently my ministry completed a comprehensive study of the excise product industries in close consultation with most of the firms concerned. On the basis of this study, the government is satisfied that there is no case for substantial change in excise duty rates at this time.

However, to give a stimulus to the brewing and soft drinks industry, I am reducing the excise duty rates from 80% to 70% on beer, and from 50% to 40% on soft drinks. I will monitor the effects of these reductions very carefully.

If they do not result in reduced retail prices, we will not get the demand response to offset the revenue loss from the rate reductions. If the tax reductions are used simply to enhance margins for producers and distributors, I will not hesitate to restore them to their original levels. The revenue reduction from these lower excise duties will be about Shs4 billion.

Sales Tax

The 10% rate of sales tax is being increased to 12%, with an important exception for essential foods.

The finance bill will indicate the food items which will not be increased to 12%. One important consideration in increasing the 10% rate is that we must prepare for the introduction of Value-Added Tax, for which we intend to have a uniform rate.

This means our lowest sales tax rate must rise a little. I estimate this sales tax change will increase revenue next year by Shs9 billion.

Withholding Taxes

I propose to raise the withholding tax on commercial transactions from 2% to 4%. The 4% will apply, as a present to imports and a range of domestic transactions.

However, I am making an important change in the administration of this tax. It will apply only for those transactions where the tax affairs of the importer or the domestic supplier are up to date.

The URA will publish a list showing those whose tax affairs are up to date and who therefore will not have to pay the 4% withholding tax rate. I expect these new arrangements will encourage many enterprises to get their tax affairs in order quickly. The additional revenue in 1994/95 from this measure is estimated at Shs9.2 billion.

Harmonization of import taxes: In 1993/94, a harmonized commodity coding system was introduced for import duties, excise duties and sales tax. This comprehensive code is now being modified to reclassify goods into luxury, intermediate and essential categories.

The effect of this reclassification is to harmonize tax rates; the guiding principle for finished goods is that luxury and less essential goods attract the highest tax rates.

The principal features of this reclassification are as follows:

- Raw material imports for the industry are in the main being harmonized to a duty rate of 10%. However, for imports into key industries whose raw materials are not likely to be produced locally soon, I will remit the duty.

This procedure can be used to remit duty on key inputs such as steel billets and inputs into the manufacture of pharmaceuticals and for products needing petrochemical inputs.

The essential considerations here are that inputs must be for important and high value-added industries and that the inputs are not available locally.

- For certain construction materials, the rates of sales tax are being reduced to 10%. Important products affected here include paints, vanishes, tubes an pipes.

- Tax rates on textile imports are being harmonized with rates mainly being reduced. This measure will also counter the practice of diverting textiles in transit into the local market.

- Import duty and sales tax rates of all private passenger vehicles with engines above 1500cc are being harmonized at 30% duty and 30% sales tax.

- Other changes will be found in the finance bill.

To facilitate improved record keeping and greater office efficiency, import duty and the sales tax on office equipment such as typewriters, computers, calculators, office stationery, and similar goods for office use are being reduced. For example;

1- For automatic typewriters and word processors, the import duty is being reduced from 30% to 10%, and the sales tax is being reduced from 20% to 10%.

2- For electronic calculators, the import duty is being reduced from 30% to 20%, and sales tax is being reduced from 30% to 20%.

3- The sales tax on computers and computer accessories and peripherals is being reduced from 20% to 10%.

I am increasing the rate of sales tax on imports of used clothing to 30%. This measure will contain strong growth in this import category in recent years.

This is essential to encourage the development of a clothing and textile industry in Uganda. I am also concerned that our present taxes on used clothes are facilitating the import of inferior quality goods.

To supplement this tax measure, I am also terminating tax exemptions for all used clothing imports by NGOs. All the above tax measures take effect from midnight tonight.

National Lottery: Members of the House will recall that the government has decided to reactivate a lottery operation in Uganda. During 1993/94, an agreement was concluded with a lottery promoter, and sale of lottery tickets is expected to start very soon.

I am budgeting for new revenues of Shs2 billion next year from the lottery.

Customised vehicle registration numbers: During 1994/95, URA will allow vehicle owners an element of choice in the vehicle registration number they wish to use. This will involve a special extra charge for each application.

Other revenue measures

Having dealt with the main revenue-generating measures, I now want to deal with a number of smaller changes which have important although in some cases unquantifiable implications for revenue collection.

Interest Earnings: The income tax code provides for full taxation of interest with a withholding tax of 15%. However, because of administration difficulties, little or no tax is collected on this income.

I am therefore proposing a small change in present arrangements to make tax collection easy. From 1994/95, a 10% tax deductible at source by the financial institutions will apply for interest earnings.

For individuals, this 10% deducted at source will be a final liability, and so, a taxpayer will no longer need to include details of interest earnings in their tax return.

For corporate entities, however, interest earnings will be treated as normal income and so the tax deducted at source will be credited in determining the final tax liability.

I expect this new tax arrangement for interest earnings will generate additional revenue of Shs2 billion in 1994/95.

Corporate Tax: In order to encourage business development in upcountry areas, I am proposing an incentive of 100% accelerated depreciation for investments outside Kampala, Entebbe, Jinja and Njeru.

Withholding Taxes: I am raising the threshold for the 2% withholding tax on commercial transactions from Shs50,000 to Shs1,000,000.

The finance bill also includes a provision to reduce the withholding rate for various fees from 20% to 40%; one of the most important items here being payment of professional fees. There will be no change in the withholding tax rate for similar payments to non-residents.

Commercial Transaction Levy: I am proposing two changes in CTL coverage. Firstly, I am changing the law so that the levy will not apply to service exports. Secondly, I am proposing to extend CTL coverage to road freight.

The CTL charge will be levied in respect of all goods vehicles at the same time as the motor vehicle license is paid. The charge for each vehicle will be determined by its gross weight, and like the license fee, payments by instalments will be accommodated. Details of the charges will be shown in the finance bill. I expect to raise Shs2.5 billion in 1994/95 from the CTL charge on commercial vehicles.

EXEMPTIONS

In last year's budget speech, I spoke at some length about the problems caused by exemptions, and I made some changes to limit exemption losses. My ministry is still heavily burdened by applications for a vast range of exemptions.

I am now instituting additional measures to reduce the volume of applications and to speed up the decision making the process.

For all goods that are clearly exempted under the law, or in accordance with the investment code, or in terms of an agreement with the government, URA will clear the goods without a need to involve the ministry.

All that is required here is that there is complete clarity on the goods being exempted. Vague or general descriptions of exempt goods in agreements with the government will not be sufficient.

Accordingly, organisations like NGOs for example, which have agreements with vaguely worded exemptions must have them revised to spell out exemptions clearly. By making exemption provisions clearer, goods can be cleared faster.

In making exemption provisions more specific, I must make it clear that I will only entertain exemptions which are well justified.

For NGOs, I will allow exemptions only for inputs into projects serving fundamental needs, for example, basic health, education and similar essential development needs, or for disaster relief. I am not willing to extend exemptions to NGOs which are established, simply as a vehicle for importing tax-free goods which found their way into normal trade.

I have decided to terminate tax exclusive tendering for government and donor-funded projects.

The purpose here is not to ask donors to finance any tax elements of project costs but rather to make administration easier and eliminate the large scope for abuse under present arrangements.

Government will finance any additional cost caused by tax inclusive tendering by simply making a larger budgetary provision. This should not result in any net increase in government spending.

Indeed there should be a net gain reflecting not only the taxes collected on inputs but also the beneficial effects of easier administration and less abuse.

I am instituting a procedure to ensure that tax exemption provisions in work and employment contracts with the government are more fully monitored. In futures, these exemptions will require the specific approval of my ministry.

This approval will only be given if the exemption is required in terms of the funding agreement between the government and the donor. For contracts that do not involve government, references to tax exemptions well be ignored by URA.

I am also terminating the tax privilege enjoyed by parastatal organizations. From now they will have no entitlement to procure tax-free inputs or to pay tax-free salaries.

This change is essential for easier administration and to eliminate opportunities for abuse.

Normal tax treatment of parastatal organisations is necessary also to ensure that they conduct their business on commercial lines, without the competitive advantage given by hidden subsidies or tax privilege.

I am terminating with immediate effect the tax exemption now enjoyed by Uganda Railways Corporation on petroleum fuels.

I expect that the tax exemption changes and improvements I have just described will provide additional revenue of Shs 9 billion in 1994/95.

Administration Issues

Last year I announced the creation of a complaints unit in URA. I now feel that we must go further to establish an independent appeals authority if they have failed to reach an agreement with URA about an assessment.

The current law provides for local appeals committees, but even if these had been established, they may not be adequate to deal with complex issues, which often arise in the tax affairs of larger enterprises.

For the longer term, use of the court system or creation of an appeals tribunal might be the best solution. However, for various reasons, this cannot be implemented quickly and cannot meet the short-term need.

To provide immediate service, I am proposing to recruit an appeals commissioner who will work within the office of the Inspector General of Government. Thus he will be independent of my ministry and URA.

Last year I announced the introduction of the taxpayer identification number (TIN) system. So far, numbers have been assigned to about 40,000 businesses, and 200,000 individuals.

All clearing agents are now required to declare their TINs before goods will be cleared. To strengthen the operation of this system, I am proposing the following measures.

a - That local authority is empowered to issue licenses to all businesses within their area, whether or not they are licensed elsewhere. And;

b - That all clearing agents must with effect from July 1, declare TINs of the importers.

The Uganda Revenue Authority is currently reviewing the motor vehicle registration process, with the view of making it less bureaucratic. The aim of the review is also to close revenue loopholes.

One intention of the new registration process is to have all vehicles registered before they leave customs control. Uganda Revenue Authority will soon announce details of these changes.

To facilitate revenue collection by local authorities, I am abolishing the requirement for a tax-clearing certificate before issuing a trading license. However, local authorities must submit lists of all licenses to URA. Control and monitoring in this area will be assisted by the taxpayer identification number system.

To assist the cash flow of taxpayers, I am instituting arrangements for paying by tax deposits by instalments. Because of serious non-compliance by vehicle owners, vehicles tax deposits will be payable at the same time as the road license, in proportion to the duration of the license.

All taxpayers will have the option to pay the whole deposit instead of paying by instalments.

Publication of updated tax legislation

Publication of a consolidated income tax code is well overdue. I am happy to say that work on this task is well advanced, and I hope to present a consolidated code to this code during 1994/95.

A technical committee including representatives of my ministry, the ministry of justice, and the URA has completed a review of the laws relating to customs, excise duty and sales tax.

Consolidated texts of these laws will soon be submitted to cabinet and immediately thereafter, be tabled in the House.

URA refunds of overpayments and duty drawbacks

There have been complaints that the refunds of overpayments and the operation of the duty drawbacks scheme are complicated. With effect from July 1, URA will be able to make direct refunds of tax overpayments and duty drawbacks.

However, where an overpayment or drawback involves someone who pays similar taxes regularly, the problem can be resolved by allowing a tax credit. Accordingly, URA cash refunds or tax credits will commence in 1994/95 to resolve this contentious issue.

Bureaucracy, abuse and corruption

Members of the House are well aware of the high priority government is giving to rooting out the bureaucracy and corruption. This is particularly important in the area of tax administration. In cases where corruption and abuse are suspected or detected, strong action is being taken including dismissal and court proceedings.

Considerable progress is being made with cleaning out problem personnel in MFEP and URA, but the processing of recruiting and developing competent and reliable is long and difficult.

Here I want to stress the need for public cooperation. Bribery and corruption usually involve the public on the one hand and a public official on the other. If the general public resists the temptation to bribe or corrupt, it becomes easier for government agencies to operate on normal lines.

I am also aware of complaints from the public about sometimes arbitrary decisions and complete failure to reply to reasonable questions by taxpayers about tax issues. This applies both to my ministry and URA.

There are also complaints about delayed processing of tax returns and the reopening of closed files where final assessments have long ago been agreed. The tax appeals commissioner in the office of the IGG will deal with such complaints.

However, I have asked the URA to be more responsive and sensitive especially with taxpayers who are making a reasonable effort to comply. In particular, I insist that URA and my own ministry must provide a written reply promptly to reasonable queries from the public. The public is fully entitled to a prompt and courteous service in seeking assistance on tax matters.

Pre-shipment inspection

I have decided to introduce an element of competition into the arrangements for pre-shipment inspection services.

I am announcing that the limit for requiring pre-shipment inspection is being increased from $500 to $10000 with effect from July 1, 1994.

For imports of second-hand vehicles, the evaluation will be done by the URA - a pre-shipment evaluation will not be a requirement. Furthermore, a pharmacy board will be used for the evaluation of pharmaceutical imports.

Smuggling

The problem of smuggling continues to undermine the tax collection processes. We are now taking delivery boats to deal with smuggling via the lake. I want to repeat what I said last year about smuggling; those caught in the act will be dealt with decisively.

We will confiscate not only the smuggled goods but also the vehicles or other modes of transport used for smuggling. I have authorized the URA to pay generous rewards to anyone who gives them information enabling identification of smuggled goods.

1994/95 Revenue position