URA anniversary

25 years of building the nation

25 years of URA's transformation and building Uganda's tax base

In a journey that started in 1991-2016, Uganda Revenue Authority (URA) turns 25 years old today. Established by an Act of Parliament in 1991, URA was formed by merging three departments of customs, income tax and inland revenue, and sales formerly under the finance ministry. In addition, support departments including finance, administration and human resource were created and that is how URA was formed. Today URA marks a silver jubilee since its inception to collect central government revenue and facilitate trade in Uganda. URA, before its establishment as a tax administration institution in Uganda, faced a number of challenges among them high domestic tax rates and bureaucracies, but after 25 years could the trend have changed. URA Commissioner General Doris Akol spoke to Jacky Achan about the journey of tax system transformation

Let us start with the journey of URA. How has it transformed over the years?

The creation of URA was as a result of the inefficiencies in revenue collection at the time. Revenue was not being collected efficiently and there was a lot of leakage because there was no proper system for revenue collection. It was discovered that as part of the public finance reform programme at that the time, a revenue authority had to be created, which led to the creation of URA. On its inception, URA was headed by an expatriate commissioner general Edward Larbi Siaw from Ghana and a team of other expatriates from the UK. Over 25 years, we have seen this trend changing to the point where URA is now completely led by Ugandans and the leadership is drawn from people that have been professionally groomed and trained within URA, so that is one of the highlights of the 25-year journey.

CLICK HERE FOR MORE

URA's 25 years of robust growth

By Samuel Sanya

Three hundred years ago, Christopher Bullock, an English playwright, coined the phrase, "Tis impossible to be sure of anything but death and taxes". Though loathed by many, taxes are necessary for the government to provide critical services such as healthcare, security and infrastructure.

Maria Kiwanuka, the former fi nance minister, put it aptly when she referred to taxes as the national tofaali — a fundraising effort for all Ugandans to contribute towards the provision of critical services for which they are the ultimate benefi ciary.

Uganda has a rich history of taxation which dates back to 1900, when hut and gun tax was introduced through the Buganda Agreement. The purpose was for the public to contribute revenue towards maintenance of what was the Uganda Protectorate at the time.

Inception

The first tax legislation was introduced in 1919 under the local authorities' ordinance. After independence in 1962, the role of tax administration was passed on to the post-colonial government. In 1964, district councils were responsible for collecting local tax.

Today, the Uganda Revenue Authority (URA); Uganda's taxman, marks 25 years since inception, having been established on September 15, 1991, through an Act of Parliament. URA was initially formed to collect central government revenue and facilitate trade in Uganda. Before the establishment of URA, the finance ministry carried out tax administration.

Doris Akol, the URA commissioner general, says tax administration was characterised with a number of challenges such as bureaucratic processes, high domestic tax rates and tariffs on international trade and extensive discretionary powers to the finance minister to grant specifi c exemptions.

"There was too much reliance on international trade taxes, especially export taxes, that contributed 68% of total revenue in the 1980s and low revenue collections caused by a narrow tax base, which was followed by a low tax to GDP," Akol says. "Administratively, the mechanisms of revenue collection and accountability were quite ineffective. They involved collection of cash in offi ces and use of one commercial bank as a collection point," she adds.

President Yoweri Museveni signing the African Tax Administration Forum journal after the launch Kampala Serena Hotel in 2009. Looking on left is then URA commissioner general Allen Kagina

President Yoweri Museveni signing the African Tax Administration Forum journal after the launch Kampala Serena Hotel in 2009. Looking on left is then URA commissioner general Allen Kagina

Addressing challenges

Akol explains that URA was formed to address the aforementioned challenges in tax administration. She noted that when URA became independent in terms of civil service's rules and regulations, its independence allowed flexibility with regard to the organisational structure, staffing, salaries and incentives, procurement and budget.

"This enabled URA to make major organisational and procedural changes needed for modernisation. This was all done to improve administrative effi ciency and ensure better taxpayer compliance," Akol says.

The organisational structure of revenue agencies is a key element of reforms and modernisation programmes. URA's top management during the early 90s comprised over 60% expatriate staff. The fi rst commissioner general was from Ghana.

However, the authority has moved from employing expatriate staff in its top management to employing Ugandan commissioner generals. Akol notes that trendsetting leadership programmes within the URA such as Fired Up for Excellent Leadership for senior management and Getting Equipped and Reinforced for line managers have groomed in-house leaders.

Between 1996/97 to 2003/04, URA was faced with administrative challenges including corruption and lack of integrity among staff, ineffi cient and ineffective systems and processes. At the same time, tax rate increments were not sustainable and tax administration reforms were inadequate to overhaul the poor revenue performance, coupled with a stagnant low tax to Gross Domestic Product ratio. Further still, URA had 18 levels and 10 departments, making the structure so heavy at the top with senior management.

Structural reforms

In 2002, URA employed 2,186 staff with a management to staff ratio of 1:40. This structure was based on control and strong authority relations yet movement up the hierarchy was mainly due to seniority.

To strengthen and integrate tax administration, the URA transformation process was initiated in 2004 using four major initiatives: human resource restructuring, business modernisation, corporate image transformation and change management.

The aim of the structural reform was to re-align all core business processes and reduce the bureaucracies in reporting and form a fl at organisation structure. The reforms saw the top heavy structure improve from 11 to fi ve commissioners. Currently, the structure has six levels and seven departments, headed by commissioners, leading to a management to staff ratio of 1:100.

Employee centred

Akol notes that URA is an employeecentred organisation. People are considered critical because they drive the processes, use systems and also transform other resources into productive outputs.

She notes that there has been renewed focus on staff development during the past 25 years aimed at professionalising the organisation's human resource, which is in line with the organisation's mission of providing excellent revenue services with purpose and passion.

This has been achieved through implementation of a comprehensive staff development/staff competency enhancement programme that provides quality and cost-effective training and development to all staff.

URA has built capacity of staff and harnessed knowledge to enhance innovations without necessarily engaging external consultants. It carries out several on-job trainings. URA employed 1,945 staff in 1991/92 and currently employees 2,394 staff.

There are several staff development programmes that include; the Fired Up for Excellent Leadership for senior management, Getting Equipped and Reinforced for all the Managers, Post-Graduate Diploma in Tax and Revenue Administration, Post-Graduate Diploma in Tax Investigations, Petroleum and Oil Revenue Management and Auditing the Telecom Sector, among others.

The competency programmes have imparted knowledge, skills and attitudes that have enabled staff perform their duties competently, notably during FY 2015/16,

Recognised

URA received the African Tax Administration Forum award for best innovation in the Staff Development category. URA was recognised as a clientfocused and responsive organisation that attracts and nurtures talent and innovation to deliver a great customer experience in an enjoyable environment, a talent management framework, an attractive remuneration and benefit scheme were implemented.

The existence of staff development initiatives, performance-based governance structures and a wellestablished operational foundation have resulted in talent, loyalty and committed staff. Akol points out that, 80% of URA's current staff exit at retirement age, while others leave after serving for more than seven years.

URA was ranked three times in a row as the best employer of choice in Uganda in the years 2012, 2013 and 2014 for good salary commensurate with the work at hand, opportunities for growth, job security and strength of the URA brand.

Akol says policy reforms at the tax body increased domestic revenue collections

Akol says policy reforms at the tax body increased domestic revenue collections

Policy reforms

In order to increase domestic revenue collections, in 2009, URA focused its efforts on making improvements in tax administration, building a culture of tax compliance and enhancing public confi dence through improved service delivery than making tax rates adjustments.

In this regard, URA implemented modern systems and procedures, ranging from introduction of e-tax, fast customs clearance of goods, export information services, taxpayer's education services, and introduction of social media platforms for easier communication and faster handling of complaints.

As a result, URA has been transformed into a client-centric organisation that is highly automated with a lot of self service products. URA has made great strides in the use of electronic tax administration methods through the use of e-registration, e-filing, e-declaration of customs transactions and e payment in a bid to offer personalised services to taxpayers. Up to 90% of the organisation's processes have been re-engineered and automated during the past 25 years.

Akol notes that re-engineered processes resulted in transparency and free and smooth fl ow of operations. "With our taxpayer-centric Portal (https://ura.go.ug), we provide 24/7 electronic service delivery, anytime, anywhere with quick and high quality e-services and greater degree of transparency to taxpayers," Akol says.

"This has helped URA unearth hidden revenue and improved its public image. Based on a Client Service Survey that was carried out in 2015/16, 80.29% of the taxpayers considered the image of URA to have improved signifi cantly," she notes.

The total tax register as at the end of FY 2015/16 stood at 902,339, out of which 72,988 are non-individual and 829,351 are individual taxpayers. Uganda has a population of about 36 million and a labour force of about 15 million.

However, the international benchmark for effective tax administration outreach is around 1,000 people per tax administrator, while that of Uganda is 16 times higher at 16,1631.

Doris Akol, the Uganda Revenue Authority URA) commissioner general, concedes that Uganda's tax administration ratio implies that URA's staff outreach is below the recommended levels. she notes that efforts are being made in collaboration with the central government, to increase the number of staff so that the taxman can effectively serve taxpayers in all regions of the country.

However, she says most of Uganda's borders provide 24/7 services, including Entebbe airport. This has resulted in reduction in service turnaround time, with minimal physical interaction with the Department and reduction in taxpayers' visit to URA Offices by more than 90%.

In 1999/2000, seven banks were authorised to handle URA payments. But now, various e-service payment method have been implemented ranging from PayWay to MTN mobile payment, Mobile App and banks (currently 21 banks) to further reduce turnaround time for the taxpayers, hence increase their efficiency and profitability.

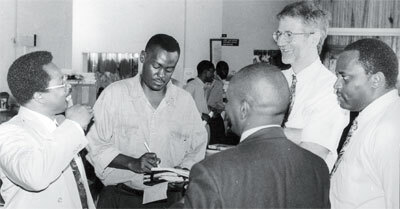

Former Commissioner General of URA, Allen Kagina, addressing traders of Nakasero during a tax education exercise in 2009

Former Commissioner General of URA, Allen Kagina, addressing traders of Nakasero during a tax education exercise in 2009

In a bid to reduce the cost of doing business, single points, known as One Stopp-Shops, that take services closer to Ugandans, have been established around Central Uganda, in collaboration with other government agencies such as the Uganda Registration Services Bureau (URSB) and the Kampala Capital City Authority (KCCA).

These collaborations are part of the well-known Taxpayer Registration Enhancement Programme. Additionally, One-stop Border Posts (OSBPs), which enable government border agencies of two given countries to operate under one roof and are involved in clearance of goods, have been established. So far,four, namely Busia, Malaba, Mutukula and Mirama Hills, are functional.

Two additional OSBPs are being constructed. Another key initiative is the Electronic Single Window system, which enables all parties involved in trade and transport to lodge standardised information and documents at a single point to fulfill all import, export and transitrelated regulatory requirements. Consequently, there has been improved transparency in the supply chain and tax revenue has greatly increased.

Tax administration

URA's tax administration models have evolved over time. In 1991, URA adopted a model based on tax types and created departments along those lines, such as indirect taxes department and direct taxes department.

This later changed to a functional approach and as a result, tax administration was organised along functions such as auditing and enforcement. "Given the heterogeneity nature of taxpayers in terms of size and nature of business done, as well as the different challenges posed for tax administration, URA adopted a taxpayer model that segmented its taxpayers along their revenue potential," Akol says.

Currently, taxpayers' segments range from large taxpayers, medium taxpayers and small taxpayers to public sector taxpayers. The criteria used to segment taxpayers range from turnover, tax payment trends to the nature of business, such as the economic sectors in which businesses operate.

"Tax segmentation has helped us provide services and tax education according to taxpayers' specific needs. We have seen the number of taxpayers in each segment and revenue contribution increase from year to year," Akol says.

Ultimately, the cost of revenue collection measured as the ratio of recurrent operating costs to net revenue collected is an indicator of the efficiency gauging institutional setups, scope of activities, performance measurement systems and strategic intervention implemented.

The URA's cost of revenue collection has been reducing since 1991 and is currently at 1.94% as of the financial year 2015/16. This has been as a result of efficient tax administration and huge investment in modernisation initiatives that have borne fruit in terms of increased revenue.

Initiatives that have been central to the reduction in the cost of revenue collection include the Single Customs Territory (SCT) procedure, which reduced clearance time from 18 days to four to six days from Mombasa to Malaba/Busia.

Border compliance controls of fuel products have also been improved. URA greatly benefited from the rolling out of ASYCUDA World, a customs management system and e-valuation database, which improved the efficiency and effectiveness of customs management.

Real-time reports from both ASYCUDA World, e-tax and e-hub, a data warehouse, are used to facilitate decision-making. Non-intrusive inspection by use of scanners has enhanced the capacity of the customs department to recover taxes from concealed goods and counter the importation of prohibited goods.

Due to a multitude of measures to improve URA's efficiency and effectiveness during the past 25 years, revenue collections have been growing steadily to enable the URA to attain its overarching goal of fully financing the Uganda national budget.

Tax revenue that previously funded approximately 48% of the national budget at the beginning of 2001/02 was in position to support 64% of the national budget in the 2015/16 financial year. In financial year 2015/16, URA collected tax revenues worth sh11 trillion, up from an initial sh0.18 trillion 25 years ago.

This resulted in a tax to GDP ratio growth from 6.97% in the financial year 1991/92 to 12.87% in the financial year 2015/16. URA's target is a tax to GDP ratio of 16% by the year 2020. All government collections from ministries, departments and agencies (MDAs) are currently collected by URA due to the efficiency of the e-tax system. The collections of Non-Tax Revenue (NTR) and other Non-Tax Revenue (ONTR) have steadily grown from sh3.65b to sh444b during the past 25 years.

Future plans

Jennifer Musisi, the executive director of Kampala Capital City Authority, one of the institutions with which UNRA signed memorandums of understanding

Jennifer Musisi, the executive director of Kampala Capital City Authority, one of the institutions with which UNRA signed memorandums of understandingURA's corporate plan was first developed in 2002. Later on, in 2008, URA adopted the Balance Score Card (BSC) framework, with the aim of aligning the organisational strategy to the Corporate Vision, Mission and Objectives and to improve internal and external communications.

It also aimed at enhancing the process of monitoring the organsation performance against strategic goals. The balance score board was fused with the Business model (BM) in financial year 2015/16 to develop the URA Corporate Plan 2016-2020 under the theme; "Cultivate taxpaying culture through provision of reliable services, leadership development and building strategic partnerships".

URA has defined the business model to clearly map out the critical elements that the organisation has to focus on to realise her strategic directions. These elements include client segments, value proposition, channels, client relationships, revenue streams, key resources, key activities, cost structures and key partners.

While the URA business model defines how the organisation, delivers and captures value, the balanced scorecard operationalises the elements in the Business Model, by laying out what shall be done, when and how.

The Balance Score card further details the initiatives per strategic objective, the corresponding measures, as well as expected targets for the planning period. URA's planning, budgeting and procurement functions have been integrated, thus improving prioritisation, resource allocation and reducing duplications, hence optimising financial resources.

URA was the first international and African institution to be recognised for excellent strategy execution by the Balanced Scorecard Institute, USA and was given an accolade for excellence in strategy execution in 2013. URA has evolved over time to become an authority that elevates transparency, excellence and integrity.

It has hosted several benchmarking delegations from over 15 revenue authorities and 10 government bodies in Africa to learn from its rich experience. Delegations from countries such as Bangladesh, Cameroon, DR Congo, Rwanda, Ethiopia, Ghana, Kenya, Lesotho, Liberia, Malawi, Mozambique Southern Sudan, Zambia, Zimbabwe and Tanzania have visited Uganda to learn from URA.

URA has implemented various initiatives aimed at fostering partnerships in order to improve the productivity of Uganda's tax system and ensure sustainable progress in the areas critical to revenue mobilisation.

"We have signed numerous memorandums of understanding (MOUs) during the 25 years, with various local and international government agencies to aid information exchange, provide technical assistance and financial support," Akol says.

Within Uganda, URA has signed MOUs with institutions such as Kampala Capital City Authority, Uganda National Bureau of Standards, Bank of Uganda, Uganda Bureau of Statistics and Atomic Energy Council.

Others are Financial Intelligence Authority, Ministry of Trade, National Drug Authority, Uganda Manufacturers' Association, Public Procurement and Disposal of Assets Authority, Uganda Communications Commission, National Social Security Fund and the Institute of Certified Public Accountants.

Outside Uganda, URA has MOUs with other EAC revenue agencies (Rwanda, Burundi, Kenya and Tanzania), South Sudan, South Africa, General Administration of China Customs of the People's Republic of China, The Korea Customs Service, Dubai Customs and United States of America.

It also has MOUs with development partners, including the Department for International Development, KfW and Trade Mark East Africa. all these improvements over the past 25 years of URA will ensure that the organisation attains its target of a tax to GDP ratio of 16% by 2020 and fully funding the national budget in the next 25 years.

URA commissioner generals over the years

DORIS AKOL: CURRENT COMMISSIONER GENERAL

She is the serving URA Commissioner General. Akol served as URA commissioner for legal and board affairs and took over from Allen Kagina, who retired after 22 years of service. Akol is the winner of the 2008 Ralph Bell Prize, awarded to the best Institute of Chartered Secretaries and Administrators fi nalist who has completed their chosen syllabus and sits more than one paper in that intake. She is a trained lawyer, with a master's degree from Makerere University and another from the University of McGill in Canada. She is credited with heading the team of lawyers in the Capital Gains Tax cases against Tullow and Heritage Oil Companies which URA won.

ALLEN KAGINA: 2004 - 2014 She served as URA Commissioner General from 2004 to the end of October 2014. Kagina succeeded the now deceased Annebrit Aslund, a Swedish expatriate, after Stephen Akabwai acted as commissioner general on an interim basis between July-October 2004. Kagina started out as a teaching assistant at Makerere University in 1985, before moving to the Office of the President. In 1992, she joined the newly formed URA as senior principal revenue offi cer, until 1998. In 2000, she was promoted to the rank of deputy commissioner for customs at URA until 2001. She was appointed Commissioner General of URA in 2004. |

ANNEBRIT ASLUND: 2001 - 2004 She served as URA Commissioner General from 2001 to 2004. She was educated at Trinity College, Dublin and Stockholm School of Economics in the UK, where she graduated with a distinction. She replaced Elly Rwakakooko, who retired from the offi ce on September 22, 2000, after declining to renew his three-year contract. Aslund beat four other candidates, namely; Henry Wade, an American, Vateec Ihno, of Asian origin; Justin Zake, the deputy commissioner general of revenue at the time and Feddy Mwerinde, the then commissioner internal revenue. Aslund was wife to a former British High Commissioner to Uganda Mike Cook. Previously, she had worked with PriceWaterHouseCoopers, an international audit fi rm. She was appointed by Gerald Ssendaula, the then fi nance minister. She passed away in 2012 after a long battle with cancer. |

ELLY RWAKAKOOKO: 1997 - 2000 He served as URA Commissioner General from 1997 to 2000. Rwakakooko was reportedly denied a second term in offi ce having been blamed for URA's failure to meet tax targets. Rwakakooko, who had been the URA boss since July 1997, handed over to Stephen Akabwai, his deputy, on September 22, 2000. |

Larbi Siaw (left) with New Vision then editor-in-chief William Pike in 1997 Larbi Siaw (left) with New Vision then editor-in-chief William Pike in 1997EDWARD LARBI SIAW: 1991 - 1996 He was the first URA Commissioner General. An expatriate from Ghana, he served the office from the time of its inception as a government revenue collecting entity in 1991 to 1996 and was succeeded by Elly Rwakakooko. A tax expert, he returned to Ghana where he is now the Tax Policy Advisor at the Ghanaian ministry of finance. |

The fight against smuggling

By Jacky Achan

John Imaniraguha, a Kampala-based businessman, made headlines recently over an incident in which he was accused and arrested over allegedly smuggling diesel and petrol disguised as aviation fuel into the country.

Aviation fuel attracts no tax levy. Also prominent but in the past (2006) was a case of wines and spirits worth sh250m smuggled into a prominent city pastor's lakeside residence of Ggaba via Lake Victoria. The smuggled goods were discovered as a result of a tip-off to the Uganda Revenue Authority (URA). According to Isa Sekitto, the Kampala City Traders' Association spokesperson, the days of outright smuggling are long gone.

"Smuggling has greatly reduced and this is due to the approach taken by URA to educate traders and taxpayers in general about their obligation to pay tax," Sekitto explains. But he says there are still pockets of smuggling in the country, especially for on demand items that are heavily taxed. High on the list of the ondemand items smuggled into Uganda are match boxes, sugar, rice because of the market protectionism in East Africa.

For sugar, traders pay 100% excise duty, for rice 75% excise duty, for match boxes 35% excise duty and for second-hand environmental items like second hand clothes and fridges 15% excise duty.

Sekitto says some of the second-hand items traders get from Europe more so things such as fridges are on demand, and are always in a very good condition. But he says because the boxes they are packaged in indicate them as secondhand, they attract a huge tax and some of the traders are instead forced to smuggle them into the country.

"Because of such circumstances people cannot pay taxes outrightly, they dodge paying the taxes because the commodity is on demand," Sekitto says. He says high tax regimes lead to smuggling. "Taxes on many of these on-demand commodities are excessively high, yet majority of our traders are in the informal sector and made to pay huge sums of money," he adds.

A trader gets to pay on a commodity 25% import duty, 18% VAT, 6% withholding tax and on top of that another 15% if they qualify to pay VAT but do not register. "That 15% for us traders is illegal since it was introduced by former Commissioner General Annebrit Aslund without an Act of Parliament. It is punishment for us traders," he says.

One of the most commonly smuggled items in Uganda are cigarettes

One of the most commonly smuggled items in Uganda are cigarettes

Sekitto says because of the high taxes, the temptation to smuggle is very high, adding that URA needs to do massive sensitisation for people to be registered to pay VAT. He says to stop smuggling, URA needs to reinforce and have people on ground to educate traders on different taxes and also counsel traders to comply to paying taxes instead of confronting them.

"For first time offenders, they should really be warned and not penalised. If you sanctioned such a person, the business will collapse and to get back, they will be forced to smuggle again," he says. Under the East African Customs Management Act, the offence can fetch a fine of up to about $10,000.

Even the vehicles used in smuggling are forfeited. Sekitto says under declaration of goods by traders, mis-invoicing and concealment needs to be dealt with rigorously. It is a big task ahead for the revenue authority. But he says to eliminate all these vices, top of which is smuggling, there is need by URA to respect the rights and obligations of the traders. "Once in a while, we need to be listened to.

A cordial relationship between URA and taxpayers will go a long way in eliminating cases of smuggling," he says. According to Dicksons Kateshumbwa, the commissioner of customs, smuggling trends have changed so much. In the past, it used to be outright smuggling, but as the business climate changes, smugglers are also changing and becoming more innovative to beat URA check points and evade taxes. We are now experiencing another form of smuggling that does with document fraud.

During the last financial year, a total of 5,595 seizures and sh37.981b was recovered. Of this, outright smuggling had the lowest sums recovered at sh4.538b. Misdeclaration registered the highest number of recoveries made at sh15.074b followed by undervaluation, other offences and concealment accounting for sh11.829b, 5.679b and sh859m respectively.

Currently, the most smuggled goods are rice, wheat, cigarettes, mobile phones and energy drinks. He said they are experiencing a staff shortage of about 500 employees. This, coupled with a low number of border posts, especially in the western part of the country, has given chance to smugglers to execute their unscrupulous acts.

"We do not have even a single station in the whole of Albertine region. We have only three stations on Lake Victoria, but these are vast areas that are often used by smugglers," he said. He also noted that there was need to massively invest in technology as their current staff can only about 40% of their work.

Information technology systems simplify revenue collection

By Jacquiline Emodek

Twenty-one years ago, Uganda Revenue Authority (URA) had only one computer in the finance department and this was used by the person who prepared the monthly financial statements.

This simply meant that other employees would do their processes manually and hand them to the person with the computer to punch them in. When it came to revenue accounting, the taxpayer had to go to the bank, where somebody would receive the money, document it on a pink sheet and put a key in the briefcase, while another key was kept in the URA office.

So the briefcase would move from the bank to the URA office, where the key would be picked for processing of transactions. "This was an inefficient way of processing transactions, so we started doing automation of our processes as well as distribution of the process of transactions from 2004-2005," Micheal Ochan Otonga, the commissioner corporate affairs at URA, says.

Initially, the organisation also had distributed processes of transactions and there were servers in every office. However, in 2007 URA offi ces all over the country were connected to the Information Technology (IT) network and the organisation started doing centralised processing of transactions. "This has made a signifi cant difference; we are able to have transactions from all URA stations, including Mombasa and Nairobi, now processed in Kampala," Otonga explains.

Centralisation of transactions meant that URA services would be available in all the stations and the volume of transactions would increase. Importantly, IT has immensely helped URA to handle the large volume of transactions. "In 2004, URA used to have 1.5 million transactions annually, but now this is processed daily and from wherever you are," Otonga says.

The ability to handle large transactions has improved on revenue collection as refl ected in URA's graph of performance, which indicates a steep growth in revenue numbers since the organisation embraced IT.

IT has also fostered the move to automation of process. Currently, more than 95% of URA's processes are automated and as a result, the organisation is able to ensure that the bank collects revenue numbers on a daily basis online and reconciliations are done by 10:00am daily.

"About 98% of our revenue is reconciled by 10:00am every day," Otonga says. This early reconciliation of taxes makes it easy for government to plan for its fi nancial commitments. Prior to embracing IT, URA had several bank accounts in different bank branches, however, because of IT, we have one account per bank.

"For example, if we have an account in Stanbic Bank, the taxpayer in Arua will put that money in the account, the one in Kisoro will also put the money in the same account and same goes for someone in Moroto, so we are able to reconcile this money and report accurate revenue figures to government," Otonga explains.

Jolly Joseph Wasswa, the manager of software engineering at URA, explains that this modification was fostered by the development of E-tax software, which allows people to pay money to the account from the different branches of a specific bank instead of one specific branch. Today, URA works with 23 out of the 26 banks licensed by Bank Of Uganda. Transfer of revenues has also been improved with IT.

"We used to transfer revenue once in a week meaning that money available for government use would not come on time, but now revenue is transferred daily to Bank of Uganda hence there is cash readily available for government,' he adds. With the new innovations in revenue collection, URA has set aside funds to encourage its staff to improve on the current ideas or come up with ideas so as to improve on its already impressive performance.

E-tax

This innovation was started in 2005 as a domestic tax modernisation project that evolved with the integrated tax system. Wasswa explains that it is a self-service system and allows people to access URA services on a 24-hour basis.

This has eased processes like application for Tax Identification Numbers (TIN) and filing for returns, which previously required the taxpayer to visit URA offices. "There was also a limitation because offices were only open from 8:00am to 5:00pm, meaning it was difficult for one to receive the services later than that," Wasswa says.

Ascuda World

This is an online system that facilitates international trade. It saves the agents from having to go to URA offices because they can easily access the service anywhere. "However, someone may have to physically bring their documents to be verified before the process can be initiated," Wasswa notes.

AskURA

This application is making a difference in terms of interfacing with the taxpayers. It is available on Google play and Wasswa says that works on the IOS version for iPhone users are underway.

Recruitment system

Since 2012, one can now apply for a job at URA from wherever they are. One can also do the aptitude test from any location. The system simply provides the timeframe for the incumbent to log in, do the test and complete at the stipulated time.

"This is an indicator of our transparency because you do not have to wait long in order to know your score; we just announce the cut- off and you will know where you fall," Wasswa says.

Not only has the innovation been effective in URA, it has also been adopted by other organisations. Other programmes developed include salary advance and leave management, which have helped to improve on the processes.

Enterprise Resource Planner (ERP)

Otonga explains the ERP enterprise Solution will bring all the corporate services in URA together. The ERP is a system meant to ease the procurement processes, general administration as well as human resource management and finance.

E-hub

This is a business intelligence data warehouse, which will ensure that decisions are made based on data and not intuition. "We want to make sure that we make decisions based on databases coming in from our systems and other data bases we are going to interface with," Otonga says.

Disaster Recovery site Data centre

In the past, URA had only one data centre, this meant that if there was a problem at this centre, the services would be down, but since 2015, the organisation now has two data centres. Therefore, if one centre is down the other one will be switched on and clients will not be inconvenienced.

Mobile payments

These were launched in September last year and are open to any mobile service provider. It is part of the drive to makes services easily accessible to the taxpayer.

E-lit

This stands for E-litigation and is used by the legal division to manage different cases. Employees also have a knowledge-sharing platform (URA Bridge) where information is shared internally. Otonga notes that besides improving its systems internally, URA is also looking at providing a system's support to its clients.

"The people who connect and enjoy our services use their systems and we need to be able to advise them on what systems they should use so that they are able to connect with us easily and partake of our services," he says.

The organisation aims at ensuring that all its processes are automated, including the document management system."Going forward, we are going to invest in IT to make it more available and more reliable," Otonga says."Going forward we are going to invest in IT to make it more available and more reliable," Otonga says.

How URA increased revenue collection

By Benon Ojiambo

During the first year of inception, Uganda Revenue Authority's (URA) customs department collected sh100.58b in taxes, contributing 55.74% and 51.95% to the total net collections and the national budget respectively.

According to Dickson Kateshumbwa, URA's commissioner of customs, this was possible due to several factors, including a narrow tax base and manual operations. "Customs used to be highly manual," he said in an interview with the New Vision on Tuesday.

He explained that there used to exist what was known as the ‘long room' through which goods could be cleared after several hours and days. However, along the way there have been changes in technological advancements and several reforms have been undertaken to suit that changing climate in which business is done as well as improving on efficiency.

Reforms undertaken included massive transformation in infrastructural set up, automation of the taxman's systems and capacity building to improve effectiveness. Systems automation also paved way for the faster clearance of goods — both imports and exports at the border points.

"Implementation of various versions of Automated System for Customs Data (ASYCUDA) to replace heavily manual systems of customs declarations, evolution of the Customs Enforcement from the militarised Anti- Smuggling Unit, and the Revenue Protection Services to the current civilian and intelligence based Customs Enforcement function and introduction of the Single Customs Territory (SCT) procedure reduced clearance time from 18 days to four to six days from Mombasa to Malaba/Busia," Doris Akol, the URA commissioner general, said recently.

CLICK HERE FOR MORE

URA gets a multibillion dollar 22-storey home

By Jacquiline Emodek

When Uganda Revenue Authority (URA) started her automation journey in 2005, the first thing that hit administration was the state of the offices. The roofs were leaking, the windows were broken and as a result they could not prevent the rain or dust from coming into the offices.

"The IT team also told us that they could only put a server in the office if it had been refurbished," Micheal Ochan Otonga, the commissioner for corporate affairs at URA, says. This led to a major renovation phase in some of the offices and construction of new blocks various stations such as Jinja district and a number of others upcountry. "The main target at this time was having offices which could host IT systems," Otonga says.

The organisation then went on to devise a major infrastructure development programme, which was comprehensive and designed for the future. In 2007, the programme was developed and it entailed building of the headquarters and field offices in different parts of the country namely Tororo, Mbale, Mbarara, Gulu and at all the border posts on prime land owned by URA.

"We showed the development plan to the finance ministry, which gave the go ahead to begin works on the headquarters first and then proceed to the field offices," Otonga says. The organisation received funding of $14.85m from the Government of Uganda for the 22-storey building.

This makes it the tallest building in Uganda, toppling Crested Towers that initially held this title with its 20 floors. Works on the building are now on the 22nd floor and it is slated for completion in February next year after one year of construction.

Expected benefits The design of the building is tailored to make it easier for the taxpayer to access services. This is because it will house the back offices and taxpayer service centres, which are currently scattered in different places in Entebbe, Mukono and Kampala.

"These are the people who will provide the service to the people who want to interact with us physically, despite our efforts in digital interface," Otonga says. The major benefit of the transfer of the back office team, however, will be integration which will ease planning of activities geared towards revenue mobilisation programmes.

URA office building under construction. All the URA staff working in Kampala will be accomodated in this building. Photos by Abou Kisige

URA office building under construction. All the URA staff working in Kampala will be accomodated in this building. Photos by Abou Kisige

At the moment, different departments are scattered in different parts of Kampala such as Kamwokya, Crested Towers, which means that if the organisation is planning an activity, it has to move staff from these various places which causes interruption.

However, with all the departments under one roof, they will simply be able to just move from one room to another to plan activities. This arrangement will also improve on the workflow because staff will be arranged according to their different roles.

"The challenge we have now is with renting places designed for something else, so you have a corner here or there which impedes workflow," Otonga says. Since embracing IT is what informed the need for new office premises and renovation, the building will provide more space for URA's data centre.

"The availability of more space means that the servers will easily cool since they will not be squeezed and in turn will make monitoring easy for us," Jolly Joseph, the manager for software engineering at URA, explains.

He adds that the convergence of offices will make it easy to manage networks and ease access to services because currently the organization relies on a third party to provide connectivity for the offices located in different places.

"As the number of people increases in the offices that are not at the headquarter premises it puts a strain on the network requirements. However, if these are all in one place, the resources can be concentrated in one place," Wasswa says.

This will also serve to reduce on the congestion on the network. "If there are so many people in an office and they are all coming through the same kind of connection, then the network will be jammed," he adds.

Notably URA has been spending $3.5m on rent in Kampala, Entebbe and Mukono annually. Therefore, with the rent burden relived, it will be able to save money. This saved money will then be injected into development of the other URA offices in Mbarara, Tororo and Masaka.

Ultimately, the new building will provide a conducive environment for its staff so as to encourage them to work. It will have a six-floor parking tower for 360 cars and 710 vehicle surface parking, a nursery for breastfeeding mothers as well as a gym for health and fitness. "In the near future we believe that people will be coming to work by train, so we plan on having a train station as well," Otonga adds.