Should workers decide how NSSF benefits are paid?

Carol, a communications expert says she has so many things to do with money like her lumpsum NSSF savings were it given to her.

BY DAVID MUGABE

Carol, a communications expert says she has so many things to do with money like her lumpsum NSSF savings were it given to her.

"Just put it on my lap and you will see," says Carol. Yet pensions experts say it is risky to plunge lumpsum money into untested waters and it could leave many retiring workers broke within a short time.

Carol's company also has an in-house savings scheme and proposals in the new law mean that these schemes will be monitored by the pensions authority.

Carol's will have to wait for the outcome of the provisions in the Liberalisation of the Retirement Benefits Sector Bill, 2011 currently being discussed by a committee of stakeholders under the Ministry of Finance.

The National Social Security Fund (NSSF) says it is in agreement that workers be given the freedom to choose whether they want their savings paid in lumpsum or part of it retained as pension once they reach retirement age.

Since provisions of the law emerged, workers are uneasy and showing mistrust basing on the past incidences when their savings have been abused or mismanaged with impunity.

Responding to a petition to Parliament by the Uganda Revenue Authority (URA) seeking a review of some of the provisions in the bill, Olive Lumonya,

the NSSF deputy communications and marketing manager said some of the contents of the URA petition may already be addressed. "We recommend that people should be given the right to choose as Tanzania did, but by the time this bill returns for debate, what URA is raising will have been catered for," said Lumonya.

The tax body proposed that in-house retirement benefits schemes should not be compelled to register and operate under the proposed law, but rather the law should leave it operational. "In URA, employees are entitled to lump-sum payments upon leaving employment.

If this bill is passed into law, it would mean that we would not be entitled to lump-sum benefit payments due as it has been the norm," James Kamara, the URA staff council chairman, said. But workers are bitter about the control that the new propositions will exercise on in-house savings scheme.

Infact, even NSSF has a staff provident fund (SPF) that would now be subject to the regulator. Lumonya said in-house schemes are internally managed and although they will be subject to the RBA, they may not follow the procedures of payment.

URA commissioner general, Allen Kagina, presented the petition signed by over 1,000 URA workers to the Speaker of Parliament. The petition said the provisions of the Bill have far-reaching implications and consequences to statutory contributions made by URA and anticipated future contributions.

URA said the Bill denies employees the lumpsum pay which has been an arrangement under the National social security fund (NSSF) Act, adding that it should be maintained.

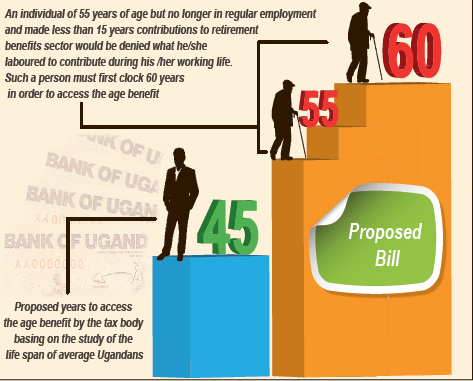

“We are of the view that the conditions for grant of age benefits are unjust. It would mean that a person who attains 55 years of age, but is no longer in regular employment, yet made contributions to retirement benefits sector for less than 15 years would be denied what he/she laboured to contribute during his /her working life,”said Kamara.

Kamara explained that; “such a person must first clock 60 years if he /she contributed for less than 15 years in order to access the age benefit.”

They proposed that the age benefit be accessible at 45 years based on the study of the life span of average Ugandans. Prof. Augustus Nuwagaba, the chairman of the Makerere Pensions Scheme said 45 is good because it comes at a time when you still have some energy. He said the money should be broken into two, the first lumpsum given to the contributor and the second is used to buy insurance annuity which has the biggest returns.

“Nobody should be allowed to decide for the other but people should be sensitised and encouraged on why they should take part of the money and use the other to buy insurance annuity,” said Nuwagaba.

NSSF deputy managing director Geraldine Ssali agreed that the age of 45 has been proposed to enable members access their savings much earlier. “However, the important issue is whether at the age of 45, having contributed for at least 10 years, a person has accumulated sufficient savings that can address their financial needs,” said Ssali.

Ssali said the operations of in-house schemes shall be guided by regulations yet to be made under the provisions of the Act. Kenneth Kitariko, the African Alliance Uganda chief said the key thing is to balance where employees have reasonable access but have longevity and an income for life.

“It should be structured in a way that it gives longevity, a lot of times when people are given option they misuse or not enough information is given and they sink it in assets and the pensioner has nothing,” said Kitariko.

Lumonya said that the majority of people signed up for lumpsum, but during the time for accessing their money, they reverted to pension. “People saw the lifestyle of people on pension and they changed to pension but it was their choice,” she noted.

Federation of Uganda Employers, NSSF, trade unions, finance and labour ministry officials have been meeting the finance ministry over the proposal. Dr Fred Muhumuza, an advisor to the finance minister said they expect that the technical aspects and cabinet submissions of the bill should be complete this financial year. He could not say whether the bill would be law this financial year.

Workers representative in parliament Sam Lyomoki said they support the age limit be reduced to 45 because people save money to use when they are still alive not in old age or when they are dead. On whether workers should have a say Lyomoki agreed. “It will be a very serious issue, why should any other person who is not the beneficiary be able to take a decision,” he said.