Uganda steps up efforts on ICGLR mineral certification, faces challenges in implementation

The certification covers 3T+G, ensuring that minerals are traced from the mine to export. By improving transparency and accountability, it helps small-scale miners access regulated international markets more fairly.

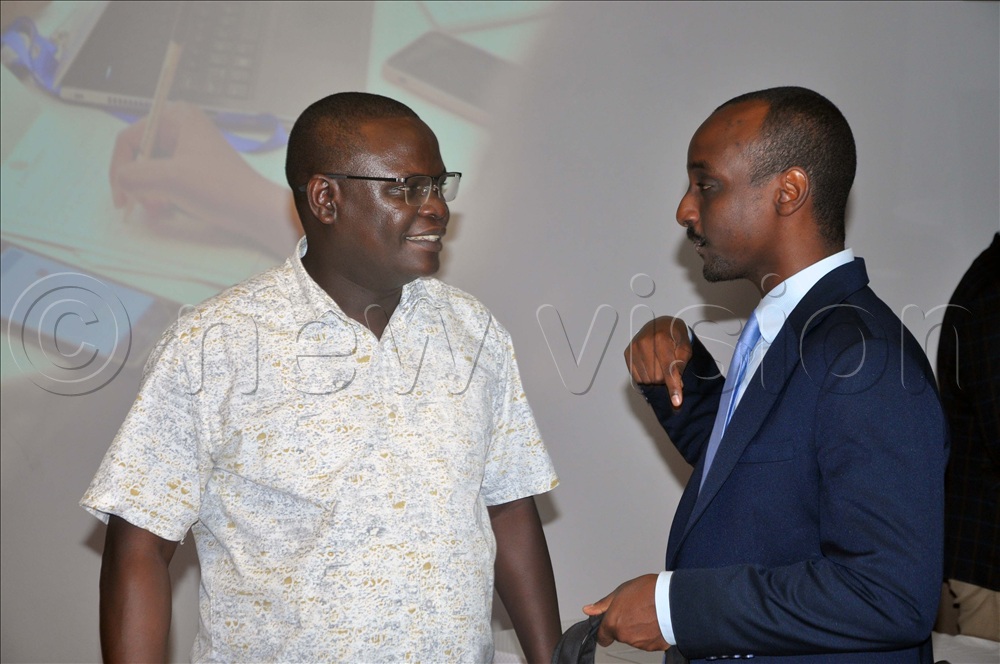

Onesmus Mugyenyi, the deputy executive director of the Advocates Coalition for Development and Environment (ACODE) addressing stakeholders in the oil, gas and mining sector at the Sheraton Hotel, Kampala. (Photos by John Odyek)

________________

Many artisanal and small-scale miners of tin, tantalum, tungsten and gold (3T and G) in Uganda remain largely unaware of the International Conference on the Great Lakes Region (ICGLR) Regional Certification Mechanism (RCM), despite its potential to benefit them.

Uganda is making progress in rolling out the ICGLR RCM. This system is designed to stop minerals from fueling conflicts while boosting their market value, increasing government revenues, and promoting sustainable development at home and across the region.

The certification covers 3T+G, ensuring that minerals are traced from the mine to export. By improving transparency and accountability, it helps small-scale miners access regulated international markets more fairly. Uganda is now the fifth member state to adopt this system."

The ICGLR was created in response to the devastating conflicts of the 1990s, including the Rwandan genocide and wars in the Democratic Republic of Congo. Backed by the UN Security Council, it brings together 12 member states to work for peace and stability in the Great Lakes region.

At the heart of its work is a legal framework, especially the Protocol Against the Illegal Exploitation of Natural Resources. This protocol guides efforts to end the link between mineral revenues and armed groups, turning commitments into action through the Regional Initiative against the Illegal Exploitation of Natural Resources (RINR).

The mining sector contributed 2.2% to Uganda’s Gross Domestic Product (GDP) in the 2022/2023 financial year, with the government targeting an increase to 10% by 2040.

The industry remains largely informal, dominated by artisanal and small-scale mining (ASM), which accounts for the bulk of production value and employment but is still underrepresented in official economic statistics.

Agnes Alaba, the commissioner in the department of geological survey and mines, ministry of energy and mineral development.

ASM directly employs between 400,000 and 600,000 people, while an estimated 2 million others benefit indirectly. Gold mining forms the backbone of this segment, making ASM the largest component of Uganda’s mining industry. To unlock its full potential, the government is prioritising investment attraction and regulatory reforms aimed at boosting the sector’s overall contribution to GDP.

Miners’ limited awareness

Many artisanal and small-scale miners in Uganda told the New Vision on Friday, 26 September 2025, that they are unaware of the RCM and its potential benefits.

“I have not heard of it,” admitted Victor Ddamba, a gold miner in Kitumbi Subcounty, Mubende District, as he worked under the sun at a busy site.

In Kasanda District, gold miner Aloysius Ssendagire echoed the sentiment: “We are mining and selling, but this ICGLR program you are talking about is new to us.”

For many miners, the certification system remains distant, abstract and disconnected from their daily struggles.

Challenges and opportunities

Experts point to underfunding, weak capacity, and high compliance costs as persistent obstacles.

Onesmus Mugyenyi, the deputy executive director of the Advocates Coalition for Development and Environment (ACODE), observed that inadequate resources limit the recruitment and equipping of inspectors. Mugyenyi noted that the high costs of environmental impact assessments (EIAs) push some small-scale miners into illegal operations.

“All governments in the region must allocate sufficient resources and treat mineral governance strategically,” Mugyenyi urged.

“Transparency reduces leakages, boosts revenues and allows citizens to benefit from their resources.”

He emphasised that full implementation of the ICGLR certification mechanism would enhance Uganda’s credibility in the mineral trade, particularly for gold, which has faced international scrutiny.

“A certification system that traces the origin of gold would reduce doubts about its legitimacy and open access to better markets for Uganda’s minerals,” he said.

He added that certification could attract investment into the broader mining sector by providing transparency and assurance to potential investors. However, he warned that without adequate resources, stronger institutional capacity, and high-level political commitment, the rollout of the RCM would remain slow.

“Governments in the region must allocate sufficient resources to mineral governance and treat it as a strategic priority. Improved transparency will curb illicit trade, boost revenues, and ensure that citizens finally benefit from their own resources,” Mugyenyi said.

Government efforts to implement certification

Agnes Alaba, the commissioner in the department of geological survey and mines, ministry of energy and mineral development, noted that Uganda has integrated ICGLR requirements into national law through the Mining and Minerals Act 2022 and formally launched certification in November 2023.

A dedicated unit now oversees implementation, registering over 6,000 artisanal miners and designating 50 operational areas. The government is developing a whistleblowing mechanism and a national mineral database.

Kedi (Right) and Kutesa (Left) discussing during a meeting on mining at the Kabira Country Club, Kampala.

Woodcross Resources, based in Mbarara District, is currently Uganda’s only certified tin exporter, producing refined tin with 99.9% purity for the European market. After the government banned the export of unprocessed minerals in 2019, the company invested in establishing a modern tin processing plant, which was officially launched in April 2024.

According to Alaba, inspections are being carried out to ensure mining sites remain free of child labor, armed groups, and conflict-linked practices.

She added that the government is recruiting at least a dozen mine inspectors to boost oversight and ensure more thorough inspections across the country’s mining sector. For gold, Uganda is building a traceability system modeled on Tanzania’s and plans to establish gold buying centers in Busia, Kasanda, Buhweju, Kampala and Entebbe.

ICGLR oversight and concerns

“Certification begins with regular monitoring of mine sites,” said Gerard Nayuburundi, Coordinator of the ICGLR Technical Unit on Natural Resources.

“Uganda has about 52 tin mine sites that should be inspected annually, but inspections are not always conducted on time.”

He added that Uganda’s tin tracking system, currently managed by a private firm, does not fully comply with ICGLR requirements, leaving a gap between production and the first point of sale.

Gold presents an even bigger challenge.

“Its high value and low volume make it especially vulnerable to smuggling. Without a robust traceability system, illegal gold can easily slip into formal supply chains,” Nayuburundi warned.

ICGLR is now drafting regional guidelines for licensing gold-tracking systems.

Private sector perspectives

For businesses, certification has brought both opportunities and burdens.

Kwesi Kutesa, of Woodcross Resources, said the company obtained an export permit for refined tin after engaging a third-party auditor from the DRC, since Uganda lacks local capacity. The audit, approved by the ICGLR Secretariat in Burundi, flagged issues such as worker safety.

For others, cost is the main barrier. Derrick Rukare, company secretary of Wagagai Mining (U) Ltd, described the process as “expensive and complex.” Rukare explained: “Independent auditors are required, and most are not based in Uganda. Costs for travel and accommodation make certification very costly.”

He urged investment in training local firms to carry out audits.

He added that they were waiting for more information on the mechanism.

Vincent Kedi, the assistant commissioner licensisng and administration of the directorate of geological survey and mines, said the certification process for tin is progressing, with EU and GIZ support helping to design chain-of-custody systems.

Some industry players question its immediate relevance. Alan Agume, Chairman of the Miners Forum Uganda, argued that certification lacks impact without stronger export volumes and wider recognition by smelters and refineries.

Frank Mugyenyi, the executive director of the Minerals African Development Institution (MADI), countered that the mechanism is essential for credibility in global markets.

“The RCM’s primary aim is to prevent minerals from fueling conflicts, while ensuring responsible production. European buyers demand certification, unlike markets such as Dubai.”

Uganda is building a more transparent mineral sector by adopting certification, traceability systems and stronger legal frameworks, aimed at opening new markets, boosting investor confidence and promoting peace and responsible mining in the Great Lakes region.