Oil industry development in Uganda - Why our slow pace is good

The world relies on fossil fuel as the main source of energy.

By Felix Bob Ocitti, Petroleum Geoscientist

It has often been spoken by some commentators and politicians that the pace of development and particularly the start of oil production in Uganda is dragging and very slow. A usual comparison is normally with Ghana which discovered

A usual comparison is normally with Ghana which discovered commercial quantity of petroleum in 2007 and by 2011 they had started production unlike Uganda which discovered commercial quantities in 2006 but to date has no commercial production. It is important to note that before any commercial production begins, a few pillars has to be in place: Institutions to effectively handle the industry operations, human resource capacity that rival international standards, relevant legislations to guide industry activities, infrastructure that comes with production among others. In all these pillars Uganda has moved several steps forward but while Ghana had an edge over Uganda due to its location at sea and proximity to oil producing nations, they have made mistakes which led to decline in their oil production just a year after start of production in one of the largest oil fields, the causes of which are for discussions on another day. I, therefore, believe the development pace of Uganda's oil industry is not slow but rather very good.

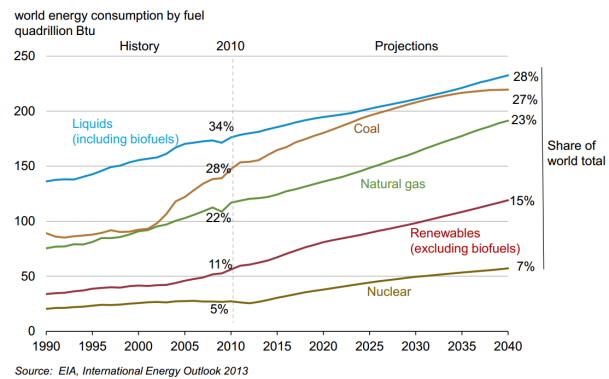

Figure 1. Projection world energy consumption by fuel till 2040 (Source: EIA energy outlook 2013)

In all these pillars Uganda has moved several steps forward but while Ghana had an edge over Uganda due to its location at sea and proximity to oil producing nations, they have made mistakes which led to decline in their oil production just a year after start of production in one of the largest oil fields, the causes of which are for discussions on another day. I, therefore, believe the development pace of Uganda's oil industry is not slow but rather very good.

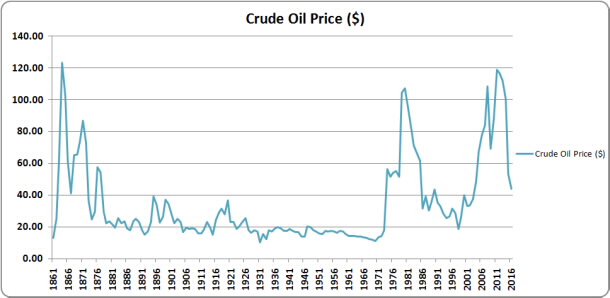

Figure 2. Crude Oil prices 1861 to 2016 (Source: BP, Review of World Energy data, 2017)

The world relies on fossil fuel as the main source of energy. According to the US Energy Information Administration (EIA), America alone consumed a total of 6.87 billion barrels (18.83 million barrels per day) of oil in 2011, 46% of that amount was imported which have since grown to about 55% in 2015. This represents approximately 22% of total world petroleum consumption. China the second largest economy consumed a total of 3.57 billion barrels, 56% of that amount was imported and growing to about 67% in 2015, Japan imported over 90% of its 1.63 billion barrels consumption in 2011 and the trend was not different in 2015. Generally, most of the major economies like Germany, France, India and South Korea all had net imports above 50%. What these statistics show is that demand for oil and gas the world over is huge and although there is increasing campaign for renewable energy amidst low oil price, demand for fossil fuel will remain high and it is increasing by the day (figure 1). Uganda's discovery, therefore, could not have come at a better time, meaning there is no shortage of market not only in Africa but all over the world and analysing the trend (figure 2) shows that a fast tracked production may lead to sacrificing a more profitable future for a relatively less profitable rapid cash inflow at a time when all the necessary pillars to govern the petroleum industry is not solidly in place.

China the second largest economy consumed a total of 3.57 billion barrels, 56% of that amount was imported and growing to about 67% in 2015, Japan imported over 90% of its 1.63 billion barrels consumption in 2011 and the trend was not different in 2015. Generally, most of the major economies like Germany, France, India and South Korea all had net imports above 50%. What these statistics show is that demand for oil and gas the world over is huge and although there is increasing campaign for renewable energy amidst low oil price, demand for fossil fuel will remain high and it is increasing by the day (figure 1). Uganda's discovery, therefore, could not have come at a better time, meaning there is no shortage of market not only in Africa but all over the world and analysing the trend (figure 2) shows that a fast tracked production may lead to sacrificing a more profitable future for a relatively less profitable rapid cash inflow at a time when all the necessary pillars to govern the petroleum industry is not solidly in place.

What these statistics show is that demand for oil and gas the world over is huge and although there is increasing campaign for renewable energy amidst low oil price, demand for fossil fuel will remain high and it is increasing by the day (figure 1). Uganda's discovery, therefore, could not have come at a better time, meaning there is no shortage of market not only in Africa but all over the world and analysing the trend (figure 2) shows that a fast tracked production may lead to sacrificing a more profitable future for a relatively less profitable rapid cash inflow at a time when all the necessary pillars to govern the petroleum industry is not solidly in place.

Uganda's discovery, therefore, could not have come at a better time, meaning there is no shortage of market not only in Africa but all over the world and analysing the trend (figure 2) shows that a fast tracked production may lead to sacrificing a more profitable future for a relatively less profitable rapid cash inflow at a time when all the necessary pillars to govern the petroleum industry is not solidly in place.

One may argue that Uganda being a developing country would need the cash from oil as fast as possible. This is true and there is no secret that Uganda's economy will improve when production begins, perhaps slowly at the start but more significantly as production progresses. However, putting our main focus on the cash and ignoring the governing principles would lead to the famous oil curse. The big exception in the oil curse story is Norway, which had the foresight to become wealthy and

The big exception in the oil curse story is Norway, which had the foresight to become wealthy and institutionalised before striking oil. As almost all the world's untapped oil reserves now lie in the developing world, Norway is not likely to have much company, if new oil countries like Uganda do not learn from them well at the beginning.

Oil being the world's most capital-intensive industry creates few jobs compared to other sectors of the economy, but worse; it has potential to obliterate jobs all across the economy. The export of oil inflates the exchange rate, so from economic perspective, whatever else a country produces or manufactures may be less competitive abroad. Norway

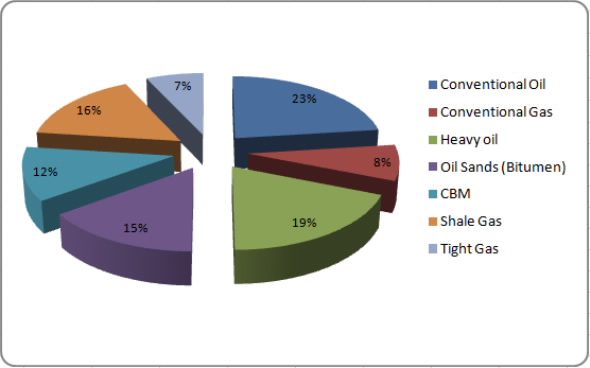

Figure 3. Worldwide hydrocarbon resources proportion in BBOE by category (Source: CGG Passion for Geoscience)

Norway learnt this early and made one radical solution aimed at preventing the oil money from destroying its existing industries: Limit the amount of money the country made from oil in the short term, in other words do not drill everything at once. As expected, it was received with skepticism by the industry who wanted to go full speed but despite skeptics, Norway handed out just a couple drilling permits a year and the rest is history of success stories.

That is just one of the lessons from Norway that can help Uganda tell oil companies, you cannot get all the oil right away in order to sustainably build other sectors of the economy and also tell citizens, you won't get the money from the oil right away so you still need to pay taxes to facilitate provision of public goods and services. However, the

That is just one of the lessons from Norway that can help Uganda tell oil companies, you cannot get all the oil right away in order to sustainably build other sectors of the economy and also tell citizens, you won't get the money from the oil right away so you still need to pay taxes to facilitate provision of public goods and services. However, the Government in particular will have checks and balances to ensure accountability because oil concentrates a nation's economy around the state and too much inflow in a short time without established channel of accountability may lead to misuse.

A more technical reason why I believe Uganda's pace of development of the discoveries is not slow is because for every step in the process we learn something new that helps to optimise future production and for every discovery, there is potential to discover even more accumulations in both conventional and probably unconventional reservoirs (figure 3).

Until recent years, many geologists didn't search for oil in unconventional reservoirs but unconventional resources from shale and oil sand has contributed significantly to North America's oil production. US now produces a lot more oil and gas from shale that although it still imports from other countries, it has started offsetting demands from unconventional shale reservoirs.

Canada has world's largest deposit of oil sands (Bitumen). Total natural bitumen reserves are estimated at 249.67 billion barrels globally, of which 176.8 billion barrels or 70.8%, are in Canada. These entire shifts from conventional discoveries came as a result of

Canada has world's largest deposit of oil sands (Bitumen). Total natural bitumen reserves are estimated at 249.67 billion barrels globally, of which 176.8 billion barrels or 70.8%, are in Canada. These entire shifts from conventional discoveries came as a result of constant study of basins, a changing mindset by geologists and engineers and of cause increasing demand for fossil fuel.

For example, before 1980, most of the oil wells drilled were vertical wells but as production rates on vertical wells declined engineers thought of a horizontal well, they tried it and production increased. Since then technology moved from horizontal well to horizontal single and multistage hydraulic fracking for shale reservoirs bringing a whole new dimension in reservoir production planning.

For the case of Uganda we may not have to re-invent the wheel but understanding the Albertine Graben and other basins and fully analysing the reservoirs which we are currently doing would give room for expanded potential, informed and optimised future production. A renowned geologist I think he was, Prof. Parke A. Dickey once said ‘'we usually find oil in a new place with old ideas. Sometimes, we find oil in an old place with a new idea, but we seldom find much oil in an old place with an old idea. Several times in the past we have thought that we were running out of oil, when actually we were running out of ideas". Prof. Dickey believed oil is in the mind of the explorer and if we allow our mind to explore continuously out of the box, perhaps we may find more oil in Uganda. If not in the conventional reservoirs may be in the unconventional reservoirs but at least for now Uganda is on the right track with the right pace of development.