Ham wins sh41b court case

Oct 07, 2020

Kiggungu contended that the banks had purportedly taken sh34b and $2,346,670 from his account without his knowledge.

COURT|FRAUD|DTB|BANKING

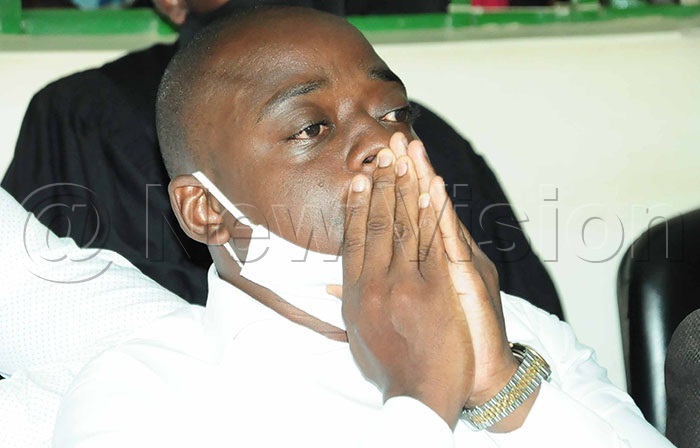

KAMPALA - Businessman Hamis Kigundu a.k.a Ham has won the sh41b loan case against Diamond Trust Bank (DTB-Kenya).

Commercial Court head Justice Henry Peter Adonyo on Wednesday (October 7, 2020) ruled that the credit facilities DTB-Kenya offered to Kiggundu are illegal since it is not licenced by Bank of Uganda as required under the law to carry out financial business in Uganda.

"The act of DTB-Kenya in conducting financial business is licenced in Kenya and it therefore illegally offered the facilities in Uganda. Consequently, this application is allowed with costs," Adonyo ruled.

In March this year, Kiggundu and his two companies Ham Enterprise Limited and Kiggs International (U) limited dragged DTB -Uganda and DTB-Kenya to the Commercial Court accusing them of fraudulently siphoning over sh120b from his accounts without his knowledge and consent.

Kiggundu contended that between February 2011, and August 2018, through his companies Ham Enterprise Limited and Kiggs International (U) limited sought and was offered credit facilities by the banks for construction of commercial properties.

According to Kiggundu, he was servicing his credit facilities but was shocked when he carried out an audit and reconciliation of the loan accounts and found out that the banks had purportedly taken sh34b and $2,346,670 from his account without his knowledge.

He also sought a declaration that the banks demand for $4,014,444 and $6,974,600 which was advanced to him by DTB -Kenya is illegal and unenforceable on grounds that the Kenyan bank had no licence to carry out financial business in Uganda.

Kiggundu argued that it was illegal for DTB Uganda to appoint DTB Kenya as the agent bank and security agent in respect to its loan.

He also wanted an order for unconditional discharge of mortgages created over his properties comprised in Kyadondo Block 248, Plot 328 land at Kawuku, FRV 1533, Folio 3, plot 36-38, Victoria crescent II Kyadondo and LRV 3176 folio 10, plot 923, Block 9 located at Makerere Hill Road and all cooperate and guarantees issued to the banks.

What the bank argued

DTB-Kenya head of debt recovery and company secretary Stephen Kodumbe however contended that the bank never conducted any business in Uganda and the credit facilities were offered in Kenya.

According to the bank, Ham Enterprise Limited is indebted to a tune of $6,298,380 on term loan facility of $6,663,453 and sh2.8b on the demand overdraft facility of sh1.5b, temporary demand overdraft facility of sh1b; $3,662,241 on the term loan facility of $4,000,000 and $4458,604 on the term loan facility of $500,000.

He argued that DTB-Uganda did not act as agent of DTB-Kenya to conduct business in Uganda but only sought its services as a collection agent for it to receive its payments from Ham Enterprises Limited.

The banks through their lawyer Kiryowa Kiwanuka claimed that the case only sought to delay Kiggundu's payment obligations and ought to be dismissed with costs because he purportedly failed to service credit facilities and is in default of payments obligations.