Ham Enterprises asks court to throw out DTB's defence

Sep 01, 2020

Kiggundu has also filed a fresh application seeking to have Diamond Trust Bank (DTB) defence in his main suit struck out.

The Commercial Court has directed businessman Hamis Kiggundu a.k.a Ham and Diamond Trust Bank (DTB) to hire services of the Institute of Certified Public Accountants of Uganda to carry out an independent audit on his bank accounts.

Justice Henry Peter Adonyo made the directives when the parties appeared in court for a scheduling conference in the matter on Monday.

"The parties are directed to hire services of Institute of Certified Public Accountant of Uganda to make an independent audit on the plaintiff's accounts to ascertain the money he is indebted and how much was purportedly debited from his accounts without authorisation. Each party should pay 50% of the charges of the audit," Adonyo ruled.

Meanwhile, Kiggundu has also filed a fresh application seeking to have Diamond Trust Bank (DTB) defence in his main suit struck out.

In his new application, Kiggundu wants the court to first pronounce itself on whether or not DTB-Kenya is authorised by Bank of Uganda to conduct financial business in Uganda.

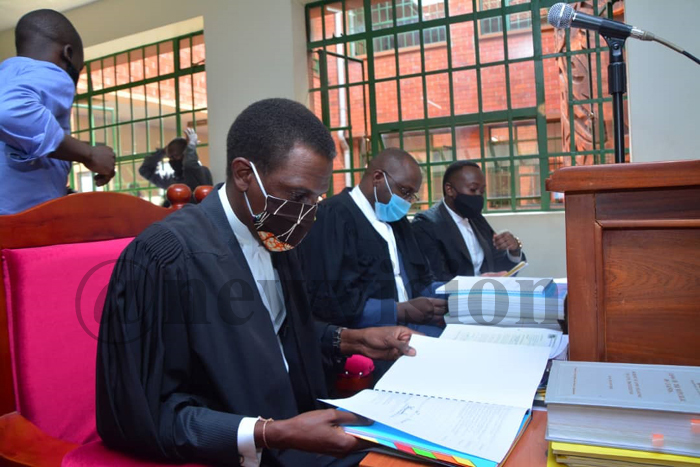

He also wants the court to determine whether or not the credit facilities it advanced to him are legal and enforceable before the main case is heard. Kiggundu's legal team is headed by Fred Muwema.

DTB's lawyers Kiryowa-Kiwanuka and Usama Ssebuwufu, however, raised concern over what they described as multiple applications being filed by Kiggundu instead of fast-tracking the main suit.

"We do not think the matters raised are preliminary points of law but only intended to delay the trial, which we believe will be addressed in the main suit," Kiryowa-Kiwanuka submitted.

The judge, however, directed Kiggundu's lawyers to serve the banks' lawyers with his new application by Thursday this week for them to make a reply to it.

"This court will deliver its ruling on the plaintiff's application seeking to have the defendants' statements of defence struck out on October 5. Parties should also appear in court ready to proceed with the hearing of the main case on that day," Adonyo ruled.

Background

In March this year, Kiggundu and his two companies Ham Enterprise Limited and Kiggs International (U) limited dragged DTB -Uganda, and DTB-Kenya to the Commercial Court. He accuses the banks of fraudulently siphoning over sh120b from his accounts without his knowledge and consent.

Kiggundu contends that between February 2011, and August 2018, through his companies Ham Enterprise Limited and Kiggs International (U) limited sought and was offered credit facilities by the banks for the construction of commercial properties.

According to Kiggundu, he was servicing his credit facilities but was shocked when he carried out an audit and reconciliation of the loan accounts and found out that the banks had purportedly taken sh34b and $2,346,670 from his account without his knowledge. Kiggundu wants a court for the recovery of this money.

He also seeks a declaration that the bank's demand for $4,014,444 and $6,974,600 which was advanced to him by DTB -Kenya is illegal and unenforceable on grounds that the Kenyan bank had no licence to carry out financial business in Uganda.

Kiggundu argues that it was illegal for DTB Uganda to appoint DTB Kenya as the agent bank and security agent in respect to its loan.

He also wants an order for the unconditional discharge of mortgages created over his properties comprised in Kyadondo Block 248, Plot 328 land at Kawuku, FRV 1533, Folio 3, plot 36-38, Victoria crescent II Kyadondo and LRV 3176 folio 10, plot 923, Block 9 located at Makerere Hill Road and all cooperate and guarantees issued to the banks.

Banks defence

The banks however argue that the case only seeks to delay Kiggundu's payment obligations and ought to be dismissed with costs because he purportedly failed to service credit facilities and is in default of payment obligations.

According to the bank, Ham Enterprise Limited is indebted to a tune of $6,298,380 on term loan facility of $6,663,453; sh2.8b on the demand overdraft facility of sh1.5b, temporary demand overdraft facility of sh1b; $3,662,241 on the term loan facility of $4,000,000 and $4458,604 on the term loan facility of $500,000.

"The terms of the credit facilities (to Ham Enterprise and Kiggs) were freely and voluntarily executed by the plaintiffs, who certified that it received independent legal advice on the same and were not unreasonable or unjust as alleged.

"The plaintiffs are at liberty to terminate the relationship but are obligated to settle any outstanding obligations," the banks contend.

In the scheduling conference yesterday, the parties failed to agree on the recovery of the money Kiggundu is indebted to the bank. The bank lawyers wanted it to be among the issues to be tried by the court but Kiggundu's lawyers objected, arguing that the bank should file its own case if it wants to recover the money in question.