Background to 1986 budget

May 28, 2019

"The industries were poorly managed, lacked working capital and could not get sufficient foreign exchange for raw materials, inputs and spare parts."

BUDGET INFALTION PROMISES INDUSTRIALISATION

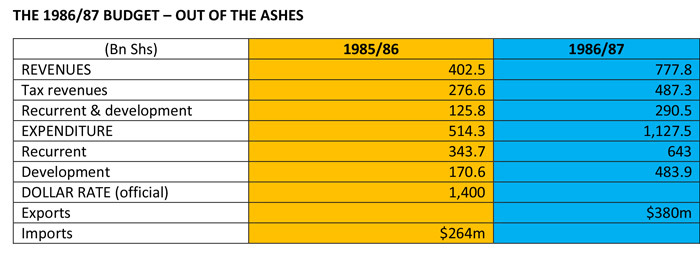

Finance minister Professor Ponsiano S. Mulema delivered the 1986/87 under less than optimal conditions well into the new financial year in August.

The NRM had taken power in January and was understandably still finding its feet.

The minister reported that in the last financial year the economy had contracted by 5.5 percent continuing a trend that started in 1978. Mulema said the economy had suffered negative growth between 1978 - 1980-14 percent before recovering 17 percent between 1980 and 1983 before further declining 10 percent between 1984 and 1985.

"There have been very high increases in prices," is all Mulema could manage in reporting on inflation, admitting that reliable statistics were hard to come by.

He, however, revealed that domestic credit had increased sharply, in 1984/85b by 130 percent and currency in circulation nearly doubled in 1985 to sh80.7b from sh43.9b the previous year. This was against a background of low food distribution and a collapse in industrial production.

"Although Uganda has the capacity to produce large quantities of commodities for export, we have continued to face transport bottlenecks and absence of appropriate marketing arrangements. In the past 15 years, the problems have been aggravated by conditions of insecurity mainly created by the behavior of governments in power themselves. This made it difficult for the food which could be produced in large quantities to reach the markets," Professor Mulema told the National Resistance Council (NRC).

"In the industrial sector, production of goods was always too small to meet domestic demand. The industries were poorly managed, lacked working capital and could not get sufficient foreign exchange for raw materials, inputs and spare parts."

Mulema said a financial programme approved by the Milton Obote government with the International Monetary Fund (IMF) only made matters worse.

The minister reported that the currency devaluations which were the principal monetary instrument under the program ground most industries to a halt because the devaluations increased the cost of raw materials and spares without a corresponding increase in the industries' working capital.

Coupled with government's undisciplined expenditure the budget deficit continued to balloon.

The explosion in bank lending may have helped but it did not go to productive sectors of the economy - agriculture and industry, but instead was shoveled towards funding trade and speculation.

"Even where production was possible, credit finance it was not available in banks because there were more profitable ventures in commerce and speculation for banks to finance," Mulema reported.

He said government was determined to reverse this trend and proposed, in addition with the existing Rehabiltation of Productive Enterprise Programme to finance agriculture and agro-based industries, the government would set up the Uganda Agricultural Finance Agency (UAFA) to finance agriculture.

Mulema also said the government was working to recapitalize the Uganda Development Bank (UDB) to finance industry.

The minister also announced that the government was \going to maintain a fixed exchange rate - sh1400 to the US dollar and abolished the dual exchange rate regime. The Obote government introduced dual exchange rate regime with foreign currency being allocated depending on whether the need was for the importation of essential or non-essential goods.

The system was widely abused by officials who allocated funds to import non-essentials using the cheaper dollars for essential imports or speculating with the hard currency by trading it on the "kibanda" market, the parallel unofficial currency market whose prices were market driven.

The government also pledged to give farmers the best possible prices for their produce.

Mulema lamented that wages remained low in the economy, noting at the lowest level a monthly salary is not enough to buy a bunch of matooke or five kgs of maize flour.

The minister then announced 50 percent increase in the government wage bill skewed towards the lower cadres in the public service.

His tax proposals w ould not have been recognized today. He announced a lowering of corporation tax on industrial and agricultural concerns to 40 percent from the previous 50 percent; and also increased income tax on banks to 60 percent from the previous 50 percent.

In addition, he removed a rebate offered to banks as an incentive of expanding up country, which could see banks completely erase their income tax liability if they grew their networks by three branches in a given year.

He doubled the import duty on petrol and, increased by half that on paraffin and by 20 percent the import duty charged on diesel. Mulema also increased the import duty and sales tax on sugar by 30 and 40 percent respectively.

In his first and only budget reading Mulema also reported he was mulling over introducing a road users tax, which funds would be used for the rehabilitation and maintenance of roads. This eventually came into force in 2002 (?) with the doing away with road licenses and a small imposed on fuel and ring fenced for the development and maintenance of the country's road network.