Media-based financial literacy launched

Aug 29, 2017

Under the project, 25 schools will each receive 200 copies of New Vision every Friday with copies of Pakasa,the newspaper’s entrepreneurship pull-out.

Forty patrons of financial literacy clubs from 22 secondary schools in Lira district were last week trained in financial literacy to enable them empower their students with financial knowledge and skills to enable them start up social and financial enterprises.

The training, which took place at Grand Pacific Hotel, Lira, was the launch of Media-based Financial Literacy, a project to be implemented by Vision Group and funded by USAID through Resilience Africa Network (RAN).

Under the project, 25 schools will each receive 200 copies of New Vision every Friday with copies of Pakasa, the newspaper's entrepreneurship pull-out.

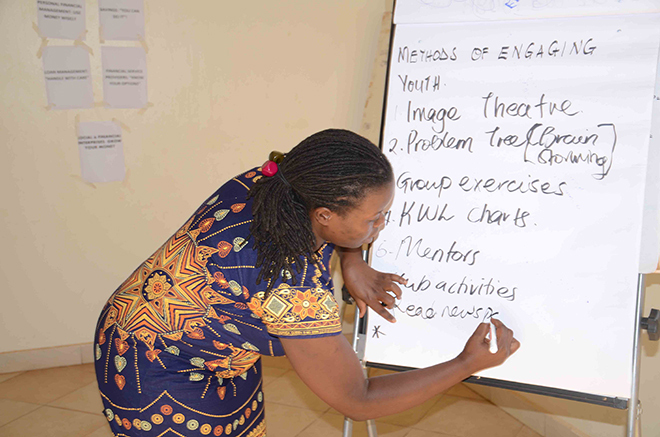

Joaniter Nanyonjo taking the participants through the training

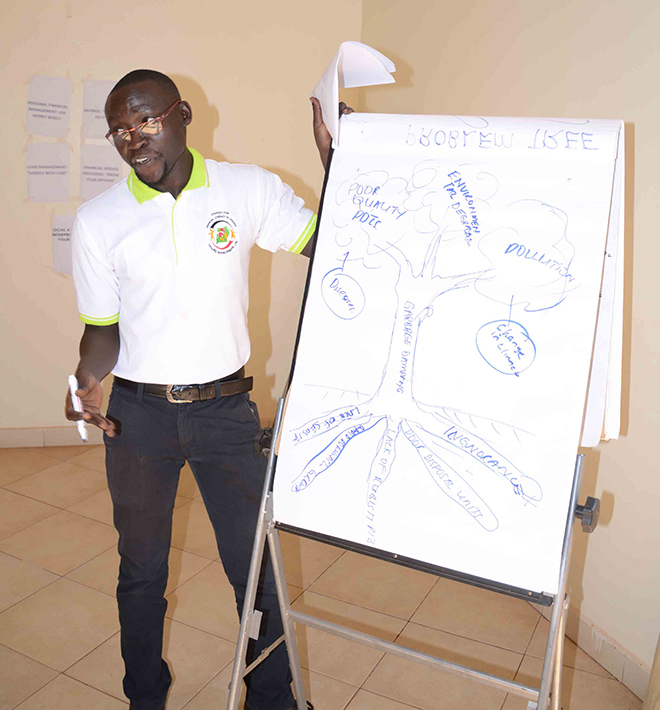

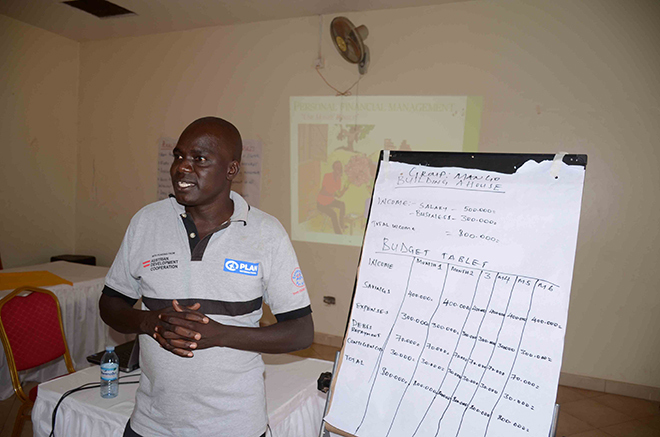

The four-session training included managing personal finances, managing loans, saving, starting up social and financial enterprises. Teachers were taught innovative ways of facilitating the sessions of the students' financial clubs.

They were taught techniques like using newspapers, problem tree approach, Know, What to know and Learn (KWL) chart, image theatre, discovery and discussion approaches too.

Joanne Nanyonjo, the newspapers in education (NiE) manager, Vision Group, said: "students should be taught how to use money wisely, save some of it and startup some small businesses. We have trained the teachers first so that they can ably guide the school clubs in their respective schools."

Christine Acai, the community development officer, Lira Municipality applauded Vision Group and partners for the project saying it would help build resilience amongst the youth.

"Their lives were badly affected by the Lord Resistance Army (LRA) war but it is time to move on from that and this project prepares them for just that," she added.

George Oranga, a teacher at Lira Town College said the project will not only benefit students and teachers but also the parents and community at large.

"Youth have a habit of wasting money yet it is the time they should be investing for the future. If we teach our students how to responsibly use money, we are going to transform our community."

Dixon Ampumuza, the team leader, Media-based Financial Literacy project said that if this pilot phase is a success, the project will expand to more schools and districts.

"With the expansion, school clubs and students starting up small businesses will be financially supported and connected to different financial institutions to access services."