FLASHBACK: When traders went on strike over VAT

Sep 30, 2019

VAT is a consumption tax that is placed on a product whenever value is added at any stage of production and at final sale.

TAX VAT STRIKE BUDGET

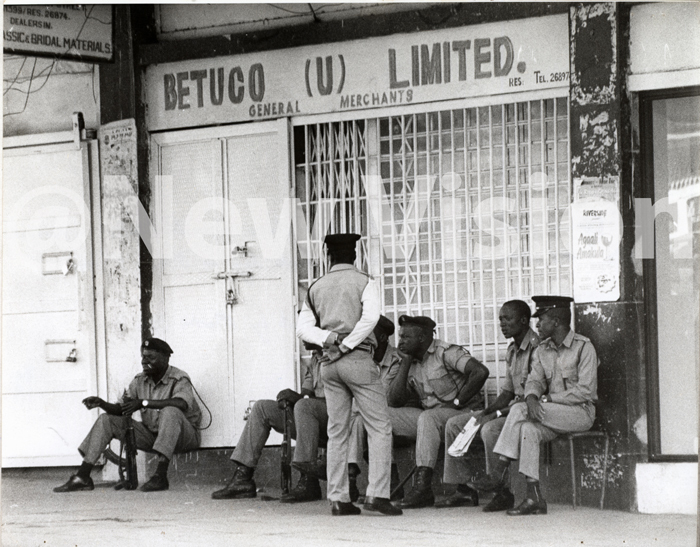

On September 30, 1996, business came to a halt. Anti-riot police patrolled the streets. Tempers rose as Ugandan traders went on strike to protest the introduction of Value Added Tax (VAT).

VAT is a consumption tax that is placed on a product whenever value is added at any stage of production and at final sale.

Reading the 1995/1996 Budget Speech, the Minister of Finance and Economic Planning, Jehoash Mayanja Nkangi, had announced the Government's decision to introduce the tax starting July 1, 1996. The VAT would replace both Sales Tax and Commercial Transactions Levy (CTL).

The irate traders, who feared the impact the tax would have on prices and demand for there products, demanded direct talks with President Museveni over the matter, shunning pleas from the Chairman of the Uganda Importers, Exporters and Traders Association, Dickson Musisi Mpiima, to open there shops as negotiations with the government continued.

A week after they had launched there strike, the traders re-opened there shops following President Yoweri Museveni's insistence that the tax would not be scrapped and that it was crucial for Uganda's economic development.

What is V.A.T?

The VAT is a broad-based consumption tax on goods and services which originated in France in the 1940s. The VAT is entirely different from all other taxes. It is not a tax on profits, gains or capital but the tax on turnover (sales).

The Police guard closed shops in Kampala

The basic principle is VAT should be borne by the final consumer of the goods or services; not the businessman. However, all those involved in the VAT chain from the manufacturer through a wholesaler to the retailer are first charged VAT and they than pass it on to the next person in the chain.